Tocvan: Heading towards Production in Sonora

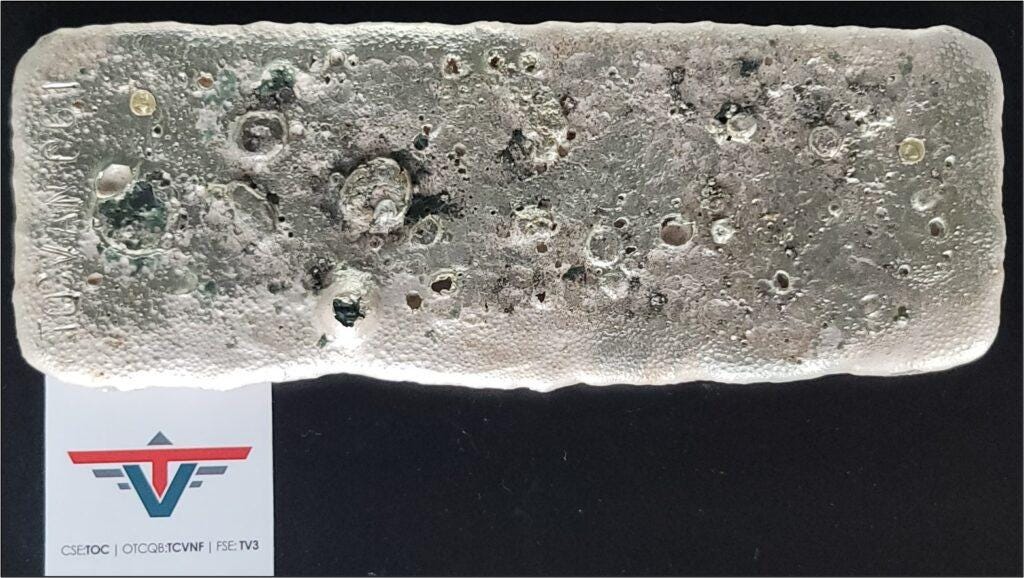

Tocvan Ventures (TOC: CNX) is one of the very few junior resource companies to have ever produced a doré bar. The bar was produced from the gold and silver heap leached from a bulk sample taken at the Company’s Pilar property in Sonora, Mexico.

“With the bulk sample we had a grade of 1.9 grams per tonne gold,” said Tocvan CEO Brodie Sutherland in a phone interview. “A big increase compared with the exploration drill holes where we were seeing on average a gram per tonne.”

Tocvan is planning an open pit mine at Pilar and that means “bulk mining” so a bulk sample is indicative of the head grades the company is likely to encounter. “We have higher grades along fault structures and surrounded by lower grade material. With bulk mining you get a representative blend of it all,” said Sutherland.

Tocvan has moved quickly to secure a large land position around the initial Pilar property. “We consolidated the area. We now have twenty times our original land position,” said Sutherland. “The geology is very consistent with mineralized outcroppings at surface, oxidized material which can be heap leached.”

The expanded land package was actually explored by Phelps-Dodge thirty years ago. “But they were only looking for copper,” said Sutherland. “They were not interested at all in the precious metals.”

The people who are very interested in precious metals are local placer miners who have been working the area for the past two or three years. “The placer miners have opened up the area to the north of Pilar. They are operating with heavy equipment and 20-ton trucks which need roads,” said Sutherland. “They are now high up in the hills in a completely different drainage than Pilar. They would not be there if they were not making money. We get along very well with the placer miners. They know we have no interest in placer but we want to figure out where the placer gold is coming from.”

“The placer miners’ roads open the ground so we can see and sample without having to clear overburden,” said Sutherland. “Which means we can explore the property quickly and put the information we get into our mining permit application.”

That mining application is expected to take about eighteen months to approve. “Before COVID it would have taken nine, but there has been a lot of turnover over and the process is taking longer,” said Sutherland. “But with the successful bulk sample in hand as proof of concept, we are in the process of planning a mine.”

Building a mine is usually well beyond the scope of a junior exploration company. Pilar is very different. “Mexico is a very low-cost jurisdiction. We have made sure to build our entire technical team in Mexico which makes sense because they have local knowledge and excellent connections to government, to the community and to other, local, mining companies,” said Sutherland. “Sonora is the center of Mexico’s mining community. There are a lot of profitable operating mines and excellent infrastructure.”

Sutherland gives the example of Minera Alamos’ Santana mine about 50km East of Pilar. “The Santana Mine was built for about 10 million dollars,” said Sutherland. “It is not a huge resource, 198,000 ounces of 43-101 Measured and Indicated gold. But it is very low cost to produce, about $1000 an ounce.”

The Pilar project is Tocvan’s primary focus however the company also has its Picacho gold-silver project also located in Sonora. TOC recently provided an update on that property and Sutherland is quoted, "We now have defined over seven kilometers of prospective trend that has seen little to no drilling, leaving the area as one of the most prospective and untested exploration properties in the Caborca Gold Belt.” The release included a rock float sample with coarse, visible, gold.

Picacho offers huge exploration potential while Pilar is being worked up into a mine.

The market continues to disappoint junior resource company investors and Tocvan is no exception, unfortunately. The overall TSE Venture has been limping along since the Fall of 2023 and Tocvan’s share price has tracked that decline. However, unlike many of its peers, Tocvan’s low exploration costs have meant it has been able to avoid significant dilution. “We’ve been working for four years,” said Sutherland. “We only have 43 million shares out.” Compare that to Minera Alamos which has over 450 million shares outstanding.

As always, the question of the country risk posed by Mexico comes up. Sutherland is very aware of this risk but takes a more granular view. “It’s an election year in Mexico. A lot of the regulatory changes being discussed are primarily aimed at issues in Southern Mexico,” said Sutherland. “Sonora is the mining hub of Mexico. Lots of open pit mines. Lots of well-paid jobs with local communities benefiting directly. The regulatory changes have not yet been approved and may never be. Any ban on open pit mining would require a two-thirds super majority in Congress needed to change the constitution. The current President Lopez Obrador does not have that super majority.”

For Tocvan it is full speed ahead to explore and develop the Pilar project with the goal of having a permitted mine in a couple of years. “We would like to build the mine and keep the outstanding shares around 60 million,” said Sutherland. In most other jurisdictions this would be impossible, but in Mexico, Tocvan is looking at a cost of only 15 to 20 million dollars for the full build.

When I wrote about Tocvan back in September 2023 I thought it was worth a look at $0.59 and a market cap of 23.6 million. With the decline in the overall junior resource market, Tocvan is now trading at 0.425 for a market cap of 18.2 million. The company has retained the services of the Howard Group for investor relations and social media outreach. Now the company deserves a very close look.

Why? Take a look at these charts:

That’s the Howard Group effect.

(You can read this piece in German here: https://www.irw-press.com/de/news/tocvan-auf-der-zielgeraden-in-richtung-produktion-in-sonora_73631.html?isin=CA0000000026)

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO. I took this look on a commission from an investor in Tocvan.

I currently do not hold shares in TOC.CSE but I may acquire shares at any time.]