I have been writing about Tocvan Ventures over at motherlodetv.net and now it is worthwhile to take another look at TOC.V’s progress in the year or so since I last wrote about the company.

Tocvan (TOC.C) has two exploration projects in the Sonora state in Mexico: Pilar and El Picacho. In the last year, with COVID largely behind us, Tocvan has made dramatic progress on both projects.

El Picacho is the larger of the projects and Tocvan undertook a maiden drill program beginning in September 2022. The land package at El Picacho is large enough that it contains several permitted drilling and trenching targets. El Picacho comes with a wealth of historical data including regional mapping, semi detailed scale (1:5000) mapping, soil geochemistry, rock geochemistry, ground magnetics, 17.8 km dipole-dipole IP in 16 lines and reconnaissance drilling. The most recent work was conducted in 2017 and 2018 by Millrock Resources partnered with Centerra Gold.

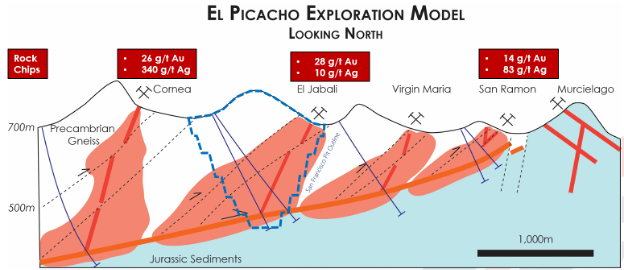

The company’s model for El Picacho is based upon this historical data and the examination of old workings. In diagram it looks like this:

Essentially the model suggests that the deposits run south to north and are relatively close to surface. (Note the blue dashed line as it represents the San Francisco pit outline. The San Francisco mine is an orogenic gold system located 18 kilometers away from El Picacho which has produced over 3 million ounces of gold. Tocvan believes El Picacho has a very similar geology and structure to San Francisco.)

Tocvan began reconnaissance drilling at a 500x500 meter target area it has named San Ramon and subsequently moved on to the south western extension of San Ramon named Murcielago. CEO Brodie Sutherland is quoted in the first El Picacho press release in January 2023 as saying, “To hit significant mineralization in the first round of drilling at El Picacho is a massive achievement and there is still more to come. We have now confirmed that the San Ramon Prospect has the potential to host a sizable near-surface bulk oxide-gold target and we look forward to reviewing the remaining drillholes to plan our next steps at El Picacho. It is important to note the significance of hitting mineralization of this style with a relatively modest drill program. We have essentially started to prove our model is correct within the first 400-meters of drilling.”

The second release of the El Picacho program was even more interesting as it confirmed the model and as Brodie Sutherland states, “We are extremely pleased with the results of this first program at El Picacho where we have not only confirmed mineralization tied to the old workings but also stepped-out and discovered even better mineralization at depth. We now have a better understanding on the optimal drill orientation to test the system and look forward to following-up on not only the San Ramon prospect but testing the other prospects across the large land package.”

Early stage exploration drilling is all about confirming a model of a deposit and, at El Picacho, a robust model has been confirmed. Now Tocvan can confidently begin to outline a resource and look at other targets on the property. “At El Picacho, initial reconnaissance drilling at the Jabali target is planned along with step-out drilling at the new discovery area at the San Ramon target. El Picacho is currently permitted for 14,000-meters of drilling and 2,000-meters of trenching.”

Where El Picacho is all about exploration, the Pilar property has moved into the “development” stage with a bulk sampling program.

Tocvan had extracted 1,400 tonnes of oxide-gold material from select areas exposed at surface. That material was taken to a private mining operation 25 kilometers from Pilar where it was crushed and placed in a heap leach pile.

Doing a bulk sample and processing it provides a great deal of information to the company before it actually begins to mine. It allows the company to calculate recoveries from expected head grades and allows the company to optimize its production process. It is, realistically, the last step before bringing a mine into production.

The bulk sample and its analysis led to a series of press releases with the final release on August 22, 2023. In that release, Brodie Sutherland sums up the process, “The Bulk Sample process has been extremely important to the understanding of the surface expression of mineralization at Pilar along with defining a path towards optimal gold and silver recovery. We are encouraged by the strong heap leach results for gold where the data suggests recovery can be improved through increased leaching solution flowrate over a consistent and longer leaching period. Perhaps the most encouraging development from the study is the characterization of exposed gold and silver amenable to rapid gravity and agitated leach recovery. A quicker turnaround for metal extraction at very high recovery rates adds a new positive factor to the development path of the relatively high-grade nature of Pilar.”

Confirming excellent recoveries while leaving room for significant improvement is what bulk sampling is about. The current results allow Tocvan to proceed with planning a mining operation at Pilar secure in the knowledge it will be able to recover an increasing fraction of the gold and silver it mines.

Critically, Tocvan entered a Letter of Intent to acquire significantly more land, 2,172.7 ha immediately adjacent and north of Pilar. As Sutherland puts it in the release announcing the acquisition, “This is a Company changing event that provides us access to what we believe is a highly prospective area adding significantly to the development potential of Pilar. Applying the knowledge we have gained from evaluating Pilar over the last few years gives us a huge advantage in quickly defining new areas of mineralization that can not only expand Pilar but also identify the potential for a new Gold-Silver District in Sonora.” This deal is supposed to close around September 25, 2023.

All of which adds up to huge progress for Tocvan. What is very intriguing is the fact that Sutherland and the rest of management have managed to take the two properties this far with only 40 million shares outstanding. While I do not currently hold Tocvan, the combination of substantial progress and a remarkably low share count, that will change.

Pilar is within sight of actual production with either the cash flow that will bring or a buy out. Either way, revenue or an asset sale will mean Tocvan will be able to properly explore the potentially much larger El Picacho deposit without having to go to the market for more cash. With a $23.6 million market cap and trading at $0.59 a share, Tocvan is worth more than a second look.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO. I took this look on a commission from an investor in Tocvan.

I currently do not hold shares in TOC.CSE but I may acquire shares at anytime. ]

Good for you! I think it is a very well managed company squeezing the most value it can out of the dollars it raises. Like most of the juniors it got hit by COVID but it has recovered and is really moving forward.

i just put in a buy order of Tocvan Ventures

i did buy earlier this year so hence i am adding to it.......so we shall see what happens........