In the Substack racket, you are supposed to post regularly to keep subscribers, gain new subscribers and, eventually, start charging for your content. I have not published since May 16th, I guess I am a hopeless Substacker. But I also respect my subscribers and I don’t want to clutter your inboxes.

In fact, I have not published because I really had nothing to say. Yes, gold and silver and copper all hit highs these last two weeks; but despite the excitement of the precious metals pundits, I don’t see the indications of a sustained upward trend. The beginnings of such a trend, perhaps.

What I do see is a new normal for gold, silver and copper with effectively a new base price for each commodity: $2300 for gold, $30 for silver and $10,000/t for copper. If this turns out to be the case it is more significant than the price highs for junior resource stocks.

While trading accounts love the volatility new highs in the commodity prices often bring to the junior market, realists understand that very few junior resource companies are even close to producing the commodities they are hunting for. (I note two exceptions to that in my own holdings: Canadian Critical Minerals (CCMI.V) and Bayhorse Silver (BHS.V). CCMI is actually producing and selling copper/gold/silver concentrate from its stockpiled material at the Bull River mine in BC. BHS has a mine ready to produce the instant the final permit is issued in Oregon.)

The process of exploration is to find and delineate an economic deposit following the steps outlined in National Policy 43-101. At every step in the 43-101 process, from the initial Mineral Resource Estimate right through to a bankable feasibility study, prices are attached to the commodities in the deposit. That price is generally a discounted version of the current spot price.

Here’s the weird thing, unless an entirely new MRE or PEA or feasibility study is done, the commodity price is not adjusted to reflect shifts in the actual price. So there are plenty of MREs floating around with $1750/ounce gold or $12.00 silver. A shift in the base price of a given commodity can make a huge difference to the size and viability of a project.

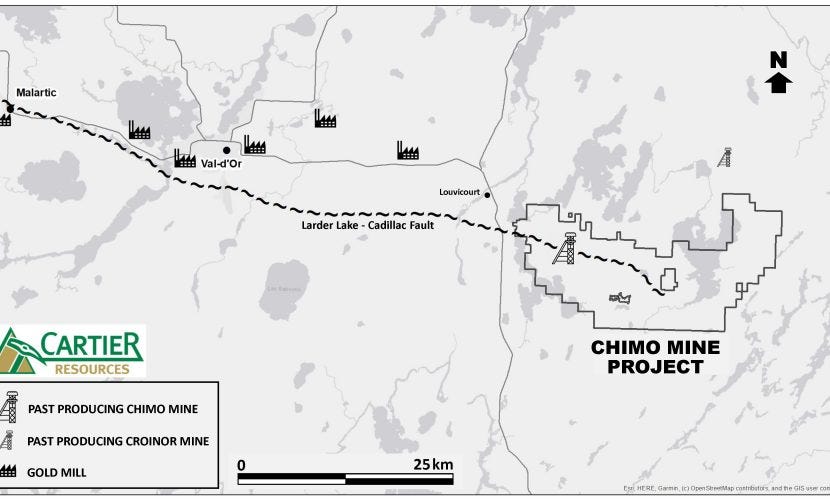

To give an example, I’ve held shares in Cartier Resources (ECR.V) for years. CEO Philippe Cloutier has, among others, a former producing gold mine in the Abitibi region of Quebec. It has advanced to the Preliminary Economic Assessment stage and has these numbers as of April 2023:

Long term gold price of US$1,750/oz, Exchange rate of CAD $1.00 = US$0.77

Post-tax NPV5% of CAD$388M and IRR of 20.8%

Post-tax payback period of 2.9 years and mine life of 9.7 years

Capex of CAD$341M

Average all-in sustaining cost of US$755/oz

Average annual production of 116,900 oz

Assuming the all-in sustaining cost remains roughly the same, the rise in the price of gold from $1750 to a new base of $2300 would add $550 USD per ounce to the bottom line, a cool $64,000,000 a year.

ECR is trading for $0.075 a share for a market cap of $26.3 million. It has 720,000 indicated gold ounces and 1,633,000 inferred gold ounces. The former Chimo mine is currently flooded but dewatering is a well-understood practice. Quebec is a great mining jurisdiction and permitting an already existing mine is straightforward. Plus, Cloutier has investigated and factored in ore sorting to improve the grades of the rock which might be shipped to any one of half a dozen mills surrounding Chimo.

At $1750 gold the Chimo project made some sense but not enough for a major or mid-sized producer to pony up the CAPEX. In its press release announcing the PEA, ECR calculates a sensitivity table for post tax Internal Rate of Return for various gold price values. At $1750 the IRR is 20.8%, the table only goes to a $2200 gold price and the IRR rises to 29.5%. At $2300 the IRR sails through 30%.

Gold juniors, even juniors with a project which has a significant 43-101 mineral resource and a full set of shafts and workings, are out of favour at the moment. They will come back into favour when the general investing public clues into the new base price for gold. Gold hitting new highs might drop that clue.

[Disclaimer: I hold positions in CCMI.V, BHS.V and ECR.V which I may add to or sell at any time. This is not investment advice. Do your own due diligence. Call the CEO.]

one caveat. The rising price of gold and silver is to a degree the result on inflation. This inflation effect capex and very likely the AISC as well. Its anyones guess as to which extent.

Have a good day, thanks for the post.