Fireworks at BIG

One of the most active boards at CEO.CA is Hercules Metals and it has been in overdrive for the last couple of days. BIG.V is out drilling at Mt. Cuddy, one of the three major sutures of the Izee/Olds Ferry terranes. (The other two are Mineral and Bayhorse Silver’s (BHS.V) silver mine and, across the Snake, Pegasus silver/copper project.) CEO Chris Price is on the hunt for what some very knowledgeable people think is a copper porphyry or, very possibly, porphyries. Until Monday, he was allied with Barrick which had invested 23 million dollars back in October 2023.

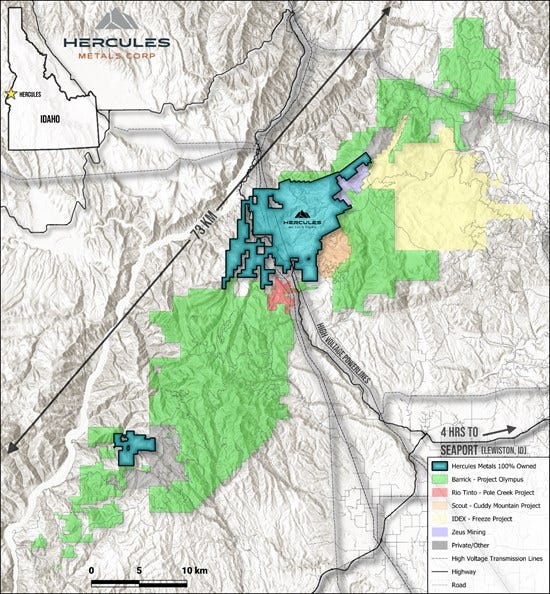

As well as investing in BIG, Barrick spent millions of dollars on helicopter staking 74,000 acres surrounding the Hercules ground and extending to the north and south of the property. Rio Tinto grabbed a bit. Scout and Zeus staked significant areas and, to the south, Bayhorse reached across the Snake and consolidated its position at the Bayhorse suture.

This land rush was triggered by a single hole reported back in October 2023,

HER-23-05, the first hole to test a large-scale (>1.8km) blind chargeability anomaly, intersected 185.29m of 0.84% Cu and 111 ppm Mo from 246m to 431.2m, including 45.33m of 1.94% Cu

BIG’s share price soared and Barrick bought in at $1.20. The share price hit an exuberant $1.60 in December. Drilling commenced and, well, the ground was difficult, water was encountered and on January 2, 2024 released the results of two and a half holes. Which were fine for step out holes but not at all what the market was looking for. The shares went from $1.40 to $0.82.

The boards consoled themselves with the certainty that a big company like Barrick could see value where retail investors couldn’t. The 2024 drill season was, frankly, a bit underwhelming, and the shares drifted downwards, trading as low as 54 cents before perking back up in mid-July to a high of $0.90. Pretty typical for a junior at the start of a drilling season.

The great knock on BIG is that while it was finding copper, the grades were only OK, and what they were finding was pretty deep. High grade copper at depth is fine, see the Resolution project, but mid to low grade copper at depth is, well, problematic.

Plus, the Mt. Cuddy deposit is geologically complicated. So complicated that BIG hired a porphyry specialist, Jamie Wilkinson, to figure it out. Wilkinson concluded that:

Unlike supergene enrichment, which is limited to narrow blankets of near-surface weathering, telescoping implies significantly greater scale and grade potential.

Which is great news in the long run. But as a CEO pal of mine said, “This is going to take 100 million in drilling and at least seven years to prove up.” Only a guess, but a well-informed one.

All of which is background to the BIG events of the last couple of days.

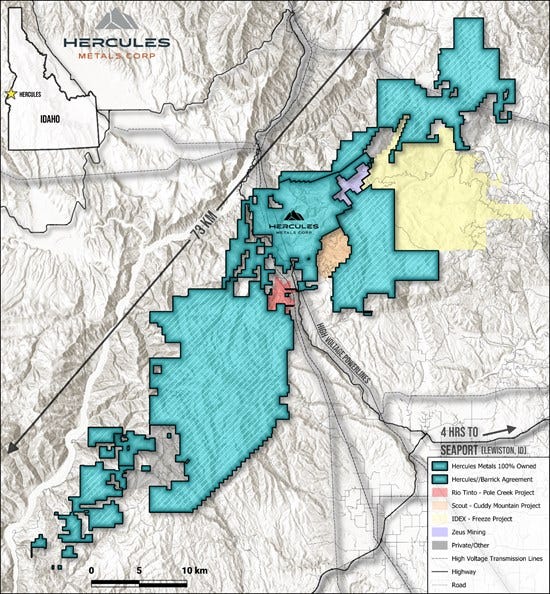

On July 28, in the morning, Price halted the stock and put out a somewhat puzzling press release. Barrick was granting an option to Hercules on all of its staking for 8 million dollars payable in cash or shares in four installments. In an instant, Hercules went from having 25,000 prospective acres to having 100,000. But did this mean Barrick was pulling out?

I don’t know what Barrick’s intentions are. However, it is clear from the press release that Barrick is maintaining an interest in the Mt. Cuddy project while stepping back from the day to day drilling and planning. If I were to guess, I would say that this is more about timelines and stretched resources than it is about the Hercules project. The Wilkinson study is very bullish on the overall porphyry system at the Mt. Cuddy suture, but it implies a much larger and longer discovery program. Barrick has a limited number of geologists and an even smaller number with any expertise in copper porphyries. From a corporate perspective, stepping back and letting BIG carry the project across the district likely made sense.

Chris Paul knew this was coming and knew that his first order of business was to raise some cash. After market, BIG announced a 15 million dollar brokered private placement at $0.70 co-led by Canacord and BMO. To no one’s great surprise, BIG shares have dropped from $0.90 to $0.70 in the last two trading days.

As I write, the dust is still settling around these two press releases. Much speculation about Barrick’s having taken a look at the unassayed core and making a decision. Which may be true, but Barrick may have had entirely corporate and resourcing reasons for stepping back a bit. Realistically, Barrick’s reasons don’t matter that much: Chris Paul now has a huge district to explore and drill.

With a season of drilling experience, some excellent IP, a robust theory of the deposit(s), cash in the bank and a set of new, closer to surface, targets Paul and his team have the opportunity to begin to establish a full scale mining district. Sure it hurts to drop $0.20 in a day and the financing is a bit dillutive (aren’t they all), but BIG’s prospects are actually brighter than they were engaged to Barrick. Paul will be able to release results without the extra time Bigcos take for analysis. He’ll be able to option out sections of the Barrick land to other area players. Hercules itself becomes a much more attractive acquisition target for another major.

It all depends on the drill results. Results which, I expect, will be released shortly and which will keep coming through the summer and fall. The BIG story is really just beginning.

(It was unhelpful to US Copper stocks generally that someone got into the Oval and said,

“Sir, we only have two copper smelters in the US. 50% tariffs on raw copper will kill us.”

And the Donald said, “OK, just the products, not the raw copper. Done.”

Copper fell out of bed.

Disclaimer: I hold a small position in Hercules Metals and a larger position in Bayhorse Silver. This is not investment advice. Do your own due diligence. Call the CEO.)