Plop!

Hercules Silver put out a news release with the assayed results of two and a half “step out” holes at its Cuddy Mountain silver/copper discovery. The results were, objectively, pretty good for step-out holes. A very rich interval of silver and decent, if not spectacular, copper grades.

The market hated the release and BIG.V as I write is trading off $0.56 or almost 41%.

Welcome to junior resource stocks. The old adage, “buy on rumour, sell on news” drives the market for anything other than stellar, bonanza, results simply because there is a layer of essentially binary players who develop great expectations and then dump shares when those expectations are not met.

The larger picture is that what Hercules is calling the Leviathan deposit looks to be big. Possibly very big. The fact that the step-out holes were drilled up to 500 meters away from the discovery hole and have all encountered “mineable” rock is very positive. There are still a couple of holes to report and I suspect they will be similar.

The release indicates that further IP studies going down to 900 meters have been completed and are being analysed and integrated with earlier IP work. This analysis will be used to plan the next drilling program.

My takeaway on this release is that what it really does is extend the time horizon on defining the deposit. The dreamers were hoping that BIG would drill directly into a high-grade copper porphyry and everyone could buy a yacht. Instead, these results suggest that there is extensive, relatively low-grade, copper mineralization over a wide area. A solid rather than spectacular result.

Interestingly enough for my own portfolio, the BIG disappointment led to Bayhorse Silver (BHS.V) dropping a cent and a half or 21%. However, BHS had already taken full advantage of the speculative excitement surrounding BIG by opening a $750,000 private placement, the first tranche of which has already been filled. (Good chance it will be oversubscribed.) “Area plays” and “closeology” can be a real advantage for a company which needs to raise money. I hold a lot more BHS than I do BIG. A lot.

Taking a step back, the BIG results do confirm that the speculation about the geology of the Izee terrane, namely that silver is overprinted on deeper copper-bearing rock, is worth following up. For BIG that process will require numerous, deep, drill holes and will take quite a bit of time. The payoff, however, could be a very large and very valuable copper deposit.

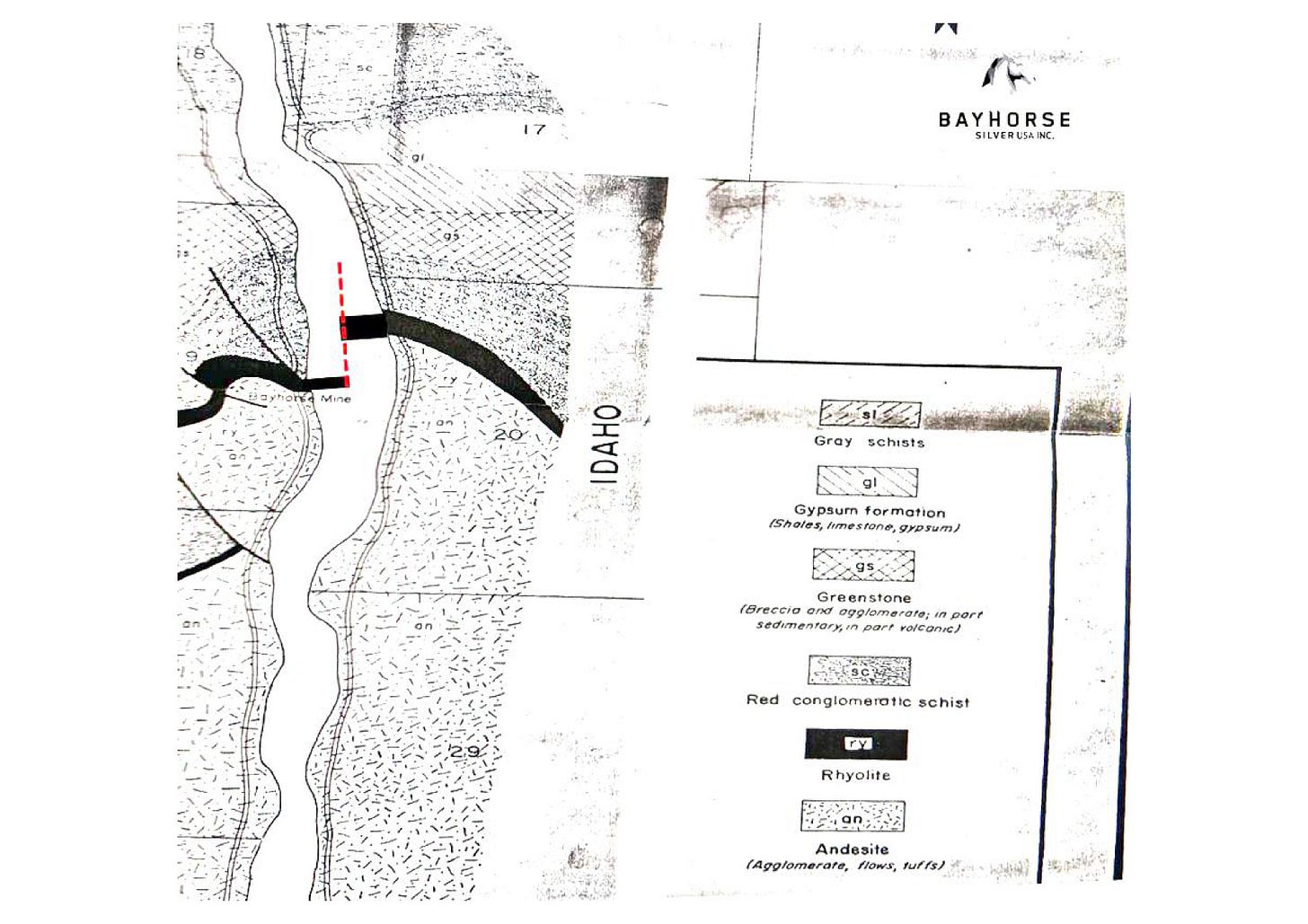

The implications for Bayhorse, as it begins to drill from its underground drill station and prepares to fly its property in both Oregon and Idaho, are significant. In a sense, the BIG results suggest what BHS should be looking for. We know BHS already finds significant copper in its mine production but the company has never really looked for copper, focussing instead on drilling to define minable silver targets in the Bayhorse Mine. The superficial geology, with its focus on rhyolite bearing silver, is promising as that is the “froth” above the potentially copper-bearing rock deeper down. For Bayhorse, the first question which may be answered by flying the property is if it shares that geology.

The VTEM survey over the entire Bayhorse property in both Idaho and Oregon (Figure 1) is to determine whether a long-postulated feeder anomaly is present that could indicate the presence of either more high-grade silver mineralization as present at the Bayhorse Mine or a porphyry copper deposit. [Bayhorse release, 18-12-23]

BIG has already had its “run” rising from under $0.20 to over $1.50 on the strength of one good hole which confirmed the presence of copper at depth and some very suggestive IP. Bayhorse has never really had that run as CEO Graeme O’Neill put together a mine, an ore sorter and a fully paid-for processing plant. For BHS the “trigger” has always been commercial silver production and that has been frustratingly delayed.

Now BHS has a potential second trigger: whether or not the geology of the Izee repeats itself. This means that BHS will have a steady news stream as it waits for the final permits for the Bayhorse Mine.

I suspect BIG will bounce back over $1.00 relatively quickly (though it might drop a little from here first), but it will be a while before it is likely to see a double or better. BHS, trading at $0.055 is at the beginning of its Izee exploration journey with money in the bank and a new and very interesting geological theory to drill test courtesy of BIG.

2024 should be very interesting for both companies.

[Disclosure: Graeme O’Neill is a friend. I own shares in Bayhorse Silver (BHS.V), a lot of shares, and may buy more or sell some or all at any time. I hold a starter position in Hercules Silver (BIG.V) This is not investment advice. Do your own due diligence. ]