A Happy Week for Dr. Copper

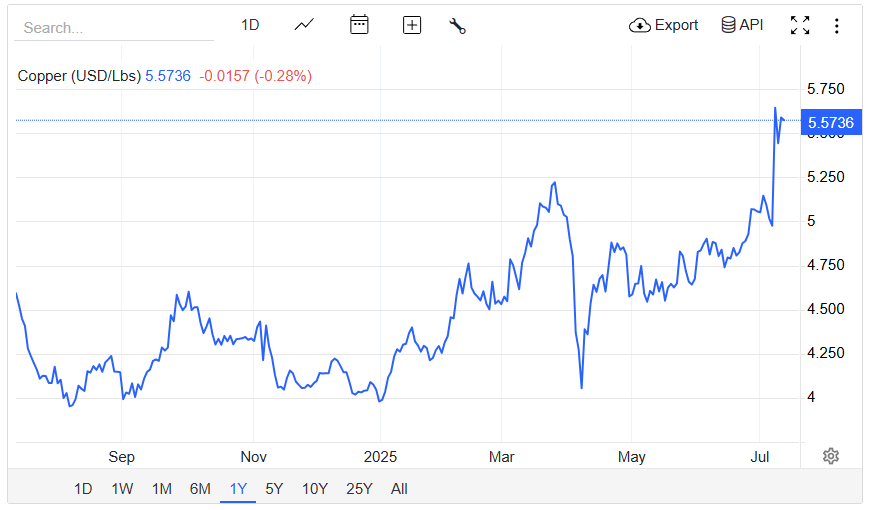

Copper hit $5.70 a pound on Tuesday. An all-time high in the wake of President Trump’s announcement of a 50% tariff on all copper imports to the US. (Which is nuts and discussed below.)

This was very good news for the share price of the two US copper plays I hold, Intrepid Metals (INTR.V) and US Copper (USCU.V). Both are a long way from production, but, as the expression goes, a rising tide lifts all boats. INTR went from 0.43 on July 4 to $0.62 July 11, USCU went from $0.085 to $0.12 July 11. This made me smile.

(Hercules (BIG.V) and Bayhorse (BHS.V) also enjoyed small lifts. However, copper is just a possibility at BHS and BIG needs to define a resource less than 500 meters down or hit a deep, Resolution like, deposit of great grade at depth. Though, to be fair, the Bayhorse mine concentrate runs 10% copper and BHS has core being assayed for copper right now. Both are maybes on the copper front, but both have enjoyed silver’s run towards US $40.00. Bayhorse has a silver mine in being, BIG has a fair bit of silver hosted in conditions very similar to the Bayhorse mine.)

Of course, the eternal question is whether this week’s surge in the copper price was a “one off” as the result of Trump’s tariffs or if it is the beginning of a bull market in copper? I’d be lying if I said I knew, but there are signals.

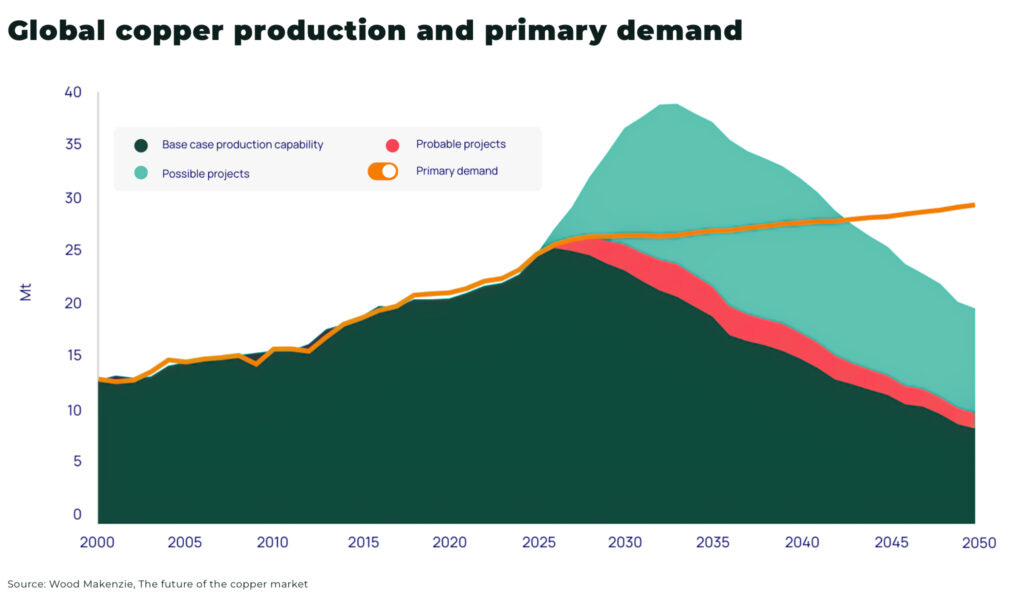

These sorts of projections are, by their nature, often wrong in detail but right in trend. Copper demand is steadily rising, and there is no reason to assume that it will stop. Production is peaking just below demand and then falling from there as old mines run out of material. Probable projects are just that, projects which are likely to come on line in the next few years. By 2030, production plus probable production will be outstriped by demand.

Which leaves demand being met by “possible” projects as early as 2030, five years from now. Copper mines don’t just pop out of the ground. They require massive investment, significant engineering and metallurgical work and enough recoverable metal in the ground to justify the risk. Critically, the financial viability of a possible mine depends on the projected price of copper. A mine which makes economic sense with $5.50 copper may make no sense at all with $4.00 copper, which was what copper was trading at in January 2025.

The divergence of copper demand from existing copper supply should ensure that the price of copper does not drop precipitously over the next few years. But even the possibility of a price drop can hurt the viability of some of the “possible” projects. Which is why I was drawn to INTR and USCU.

United States Copper has moved to a Preliminary Economic Assessment on its Moonlight-Superior project. It based its post tax Net Present Value of 1.075 billion on assumed values for copper of $4.15 a pound and its substantial silver credit at $27.40 an ounce. $5.50 copper and $37.00 silver would revise that number upwards substantially. CEO Steve Dunn’s search for a Joint Venture partner just became a lot easier.

Intrepid Metals is a good distance away from a PEA but it has been getting excellent grades in its exploration drilling in Arizona. More importantly, those grades are at reasonable depths. In the most recent release, 216.50m of 0.71% Cu, 0.28 gpt Au and 5.14 gpt Ag (0.85% CuEq) from 29.00m to 245.50m. In the copper mining world, 29 meters is barely scratching the surface. I wrote in some detail about this release and its implications last week.

President Trump’s 50% tariff on imported copper was ostensibly designed to kickstart copper production in the US. How exactly, when there are only two copper smelters in the whole of the United States, conveniently in Arizona, is a bit of a mystery. But smelting aside, copper mines and potential mines in the US are now more valuable than they were a week ago. Good news for USCU, I suspect better news for INTR.

INTR’s project, even at this early stage, has attracted a bit of large company interest. Rio Tinto staked land adjacent and to the West, Ivanhoe staked land adjacent and directly to the East. I don’t think you need to be clairvoyant to see the likely path forward for INTR. A strategic buy in at $1.00 would make sense here. But a mano a mano bidding shoot-out between Ivanhoe and Rio Tinto in the Arizona desert cannot be ruled out.

Overall, President Trump has let the copper bull out of the chute. Now we’ll see how American copper explorers ride that bull.

(Disclaimer: I hold both Intrepid and US Copper as well as Bayhorse Silver and Hercules Metals. I may sell at any time. This is not investment advice. Do your own due diligence. Call the CEO.)