Expanding the Copper Lauch Pad: Intrepid Metals

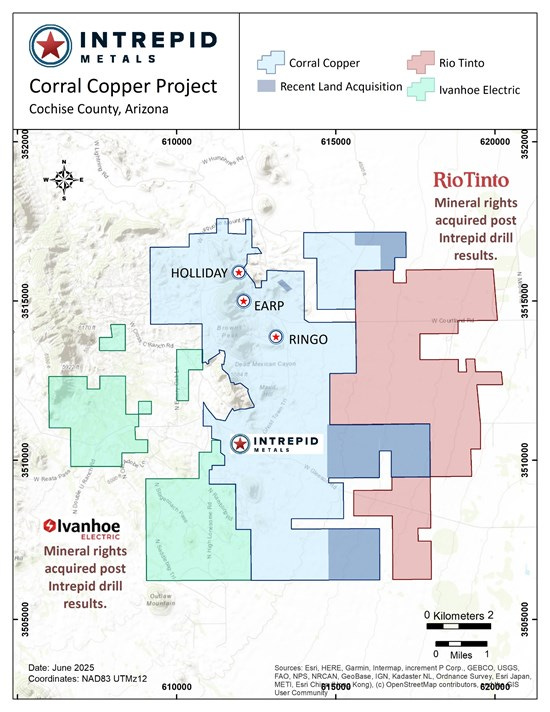

I last wrote about Intrepid Metals (INTR.V) back in January when it released publically available information that “that Robert Freidland’s Ivanhoe Electric and Rio Tinto had acquired the mineral rights for land “immediately adjacent to the Corral Copper Project” in Arizona. Today, INTR released its own land move.

the strategic expansion of its Corral Copper Property ("Corral" or the "Property") in Cochise County, Arizona through the acquisition of an additional four state leases from the Arizona State Land Department ("ASLD") and another patented mining claim

Intrepid’s CEO commented,

Ken Engquist, Chief Executive Officer of Intrepid. "By securing these strategically located state leases, we've strengthened our competitive position alongside a major industry player and set the stage for further value creation through exploration."

The expansion of INTR’s land package follows the release of encouraging, and more importantly, consistent results from the first of four diamond drill holes back at the end of May. This was followed by the release of equally encouraging results from two more holes at the end of June. Good copper grades, with a bit of economic gold, relatively close to surface, in an excellent mining jurisdiction, when copper is hitting all time highs should pop the share price. So far, though, the shares have been range bound around $0.45.

In an interview with Resource Stock Digest, CEO Ken Engquist says:

"It's at surface. We are seeing mineralization outcropping, and going to depth in long intervals at good solid minable grades. When you see something like that, you're looking at these economic models where a lot of times with an open pit, you're going to have a strip ratio. You're going to have to strip over burden, and that initial CapEx takes away from your net present value and your IRR and these economic calculations. And we don't have that. We're right into the ore body right away at good, solid grades. And then as you go down, some of those intervals get even more economic and go over 1%."

With these sorts of results, it makes a lot of sense to pick up more land if it becomes available. All the more so when Rio Tinto and Ivanhoe are standing on your doorstep.

The Corral project has all the earmarks of a serious copper/gold deposit and expanding the land position makes it all the more attractive. Each drill hole seems to confirm the company’s theory of the Corral property. So why does INTR’s share price reflect a market capitalization of only 27 million dollars with a relatively minimal 60 million shares outstanding?

My pet theory on Intrepid is that it will either be bought outright by one of its neighbours or enter a joint venture, bringing its land position and exploration to date to the table. Either event will trigger an abrupt re-rating.

In its Corporate Presentation, INTR references Faraday Copper (FDY.T) (market cap 200 million) and Arizona Sonoran (ASCU.T) (market cap 411 million) to hint at the potential rerating which may occur as development proceeds. Faraday, shepherded by the Lundin Group, is on track to provide an updated Mineral Resource Estimate and Preliminary Economic Assesment in Q3 2025. Arizona Sonoran actually filed its PEA in August 2024 with a Net Present Value of 2.03 Billion and an internal rate of return of 24%. INTR is some distance away from either an MRE or a PEA on Corral, but it is drilling to outline an economic deposit.

With any junior, it is worthwhile to check INTR cash position. As of March 31, 2025 it reports 5.6 million cash on hand. The drilling this Spring will have taken a bite however, Intrepid is drilling relatively short holes which are fairly cheap. That’s the great advantage of having a project where mineralization starts at surface.

Many copper projects, particularly those in Arizona, surface mineralization may be an expression of deeper structures. At this stage, INTR is focused on the shallow, accessible, copper/gold. But Ivanhoe has access to Robert Friedland’s deep-probing Typhoon technology which can look for structures up to 1.5 km below surface. The fact Ivanhoe has a land position next door may bring the Typhoon tech into play and expand Intrepid’s exploration potential dramatically.

I have held INTR for a while. It has been a bit frustrating watching the market ignore the obvious potential of the Corral deposit. However, with copper over $5.00 a pound, solid drill results and big companies on the doorstep, I think my patience will be rewarded.

(Disclaimer: I own shares in Intrepid Metals which I may sell at any time. This is not investment advice. Do your own due diligence. Call the CEO.)