Tracing the Elephant: BIG and ELO

Promotional CEOs are prone to say they are exploring in “elephant country”. Elephants, being notably large, the implication is that the mineral deposits their company is tracking will be huge.

Last week Hercules Metals (BIG.V) and Eloro Resources (ELO.T) each put out press releases. The two companies are at very different exploration stages. BIG has an extensive project at Cuddy Mountain in Idaho and has a single season of drilling which aimed at what Hercules believes is a copper porphyry system at one of the sutures of the Izee and Olds Ferry terranes. (Up the river Bayhorse Silver (BHS.V) is waiting on assays of its first long drill hole testing a similar theory.) Eloro has been drilling at its Iska Iska project in Bolivia for several years. Its current drill program is outlining and defining a high grade tin deposit adjacent to its silver/zinc/lead deposit. CEO Tom Larsen seems to have found two elephants.

Both companies have Induced Polarization (IP) studies of their projects which give tantalizing hints of what lies below. But there really is no substitute for drilling, the truth machine as the old geos put it.

BIG’s release reported the results of two reverse circulation drill holes. “171m of 0.64% CuEq in volcanic host rock, within a broader intercept of 354m of 0.47% CuEq ending in a late porphyry”. Pretty solid but nothing which lit the share price on fire. As it happened the RC drill “deviated” 60 degrees southwest after encountering the reported intervals. Deviations are not uncommon in drilling and as this deviation ended in a late-mineral porphyry more of the system’s structure and geometry is being revealed.

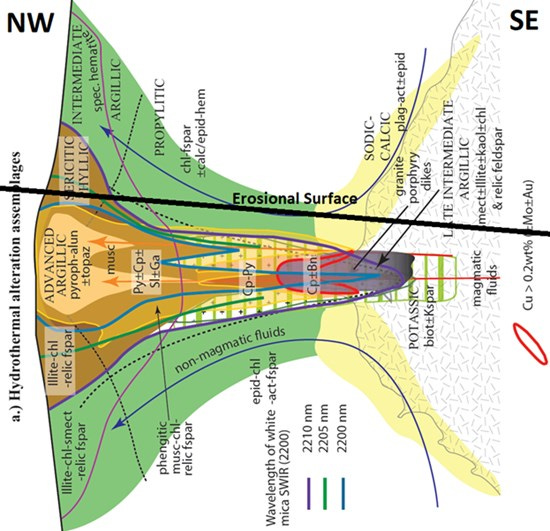

No, I didn’t put the graphic in sideways, BIG did, to illustrate, in cartoon form, what its geologists think is going on. Essentially, a very long time ago, a porphyry system was pushed over onto its side and, if BIG is right, stranded at an Izee/Olds Ferry suture. The Bayhorse mine and potential porphyry and the Pegasus project across the Snake River are on another suture and the thinking is that much the same process may have occurred.

The Hercules release goes into significant detail as to the geo-chemistry of the site and the logic of which host rocks are of greatest interest,

The porphyry fluids provide copper (Cu) and sulfur (S), but still require iron (Fe) from the host rock to form chalcopyrite (CuFeS2) and bornite (Cu5FeS4). Host rocks high in iron can therefore accommodate significantly more copper.

The release indicates that the company, perhaps in concert with other explorers in the area, plans to conduct further IP studies using a significantly deeper-seeking method to image the porphyry system to several kilometers of depth. Well below the depth the drills have reached so far.

My take away is that Hercules knows it has something but that its first season’s drilling raised as many questions as it answered. The overall structure seems to tilt upwards to the South East of the property which was not drilled last season because the US Forest Service had to grant permits to drill on land which it manages. Those permits are in hand and I suspect BIG will have a couple of drills running on that side of the project early in this year’s season.

Eloro’s Iska Iska project in Bolivia is consistently reporting good tin grades from wide bore holes drilled into what it describes as an “intrusive breccia is very likely an offshoot or apophysis from a large tin porphyry at depth”.

This release reports a hole which is, unsurprisingly, much like the drill hole ELO reported a couple of weeks ago and which I wrote about here. Long intervals of excellent tin grades in “visible coarse-grained high temperature cassiterite which is likely to be amenable to gravity separation.”

If ELO continues to report these long good grade tin holes in its “tin domain” the whole idea of there being two, world class, mineral deposits at Iska Iska will become a reality. Then what?

Iska Iska is a huge project and it is quite possible that the tin domain could be sold outright with a royalty. Or joint ventured. A lot will depend on the metallurgy of the tin. If gravity separation is, in fact, feasible then mining and concentrating in the tin domain would be relatively inexpensive.

Eloro is in the somewhat unique position of having two world class deposits. A fact which does not seem to have registered with the markets as the ELO share price seems stuck between $0.90 and $1.10. Larsen will almost certainly be going to the market for a private placement but even 10 million dollars would leave the outstanding well below 100 million. ELO has been very careful about avoiding dilution.

(Disclaimer: I hold positions in both ELO and BIG as well as BHS. This is not investment advice. Do your own due diligence. Call the CEO.)