We call my sweetie “The Empress of Tin”. Two years ago I ran across an article suggesting that there was about to be a worldwide tin shortage. I looked around for potential tin plays and there were very few companies which were focused on that extremely useful metal. But I found one, Cornish Metals (CUSN.V), which was working in the rich tin fields of Cornwall in the UK. My sweetie had contribution room in her TFSA and we took a modest position.

Off Cornish went. And in January 2022 we sold a third of the position for just a little less than 3x what we had paid for it and now our CUSN shares are 90% house money. The Empress was not happy when CUSN dropped all the way back to less than .20 in October of this year, but with an effectively zero cost base she can afford to be patient. (And the $500 in dividends from Labrador Iron Ore Royalty (LIF.T) where we put the proceeds has eased the pain.)

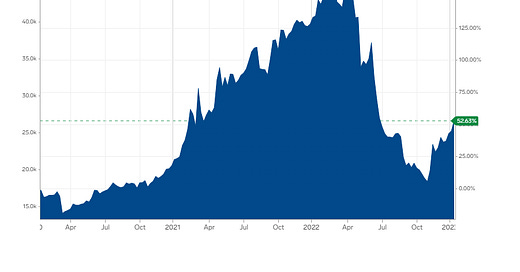

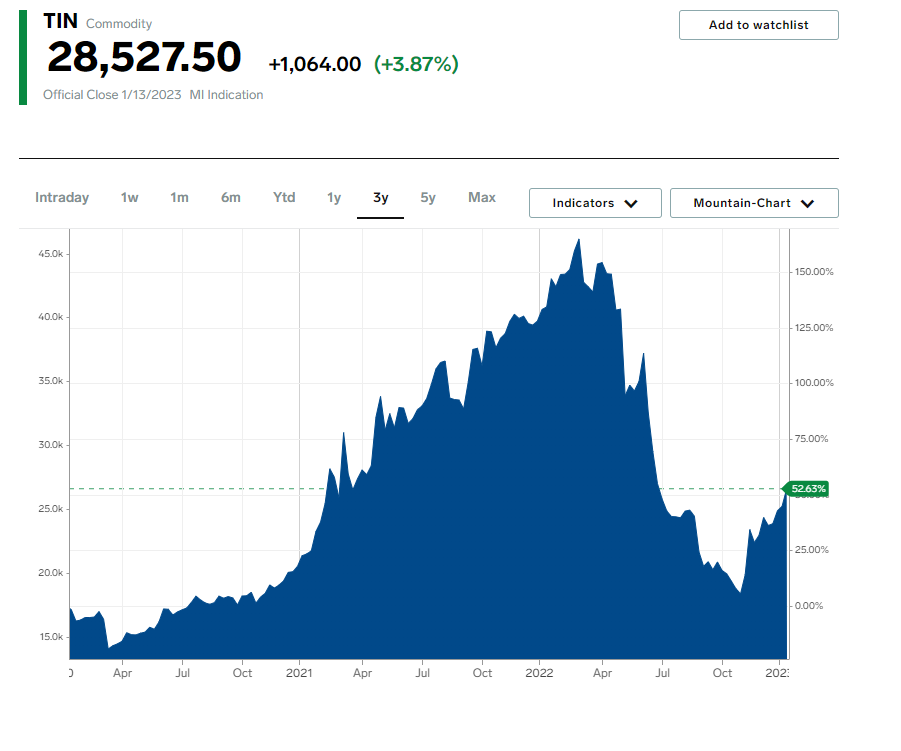

Delightful as the win was, it is rare to sell right at the top of a metal’s surge, the investment case for tin remains strong and getting stronger. The re-opening of the Chinese economy after its COVID lockdowns is part of the story. More supply is coming online from Indonesia and Malaysia, the leading tin producers, but demand is rising as well. I don’t expect a run to the March $50,000 USD per tonne mark, but $30-35,000 a ton over the next year is quite possible.

However, the investment case for CUSN is about more than the price of tin, it is also about a safe, non-Chinese dominated, source of supply. As the Company puts it on their website, “It is increasingly clear that domestic supplies of the metals critical to the energy transition is becoming a dominant theme globally. Tin is essential to all things electronic, Cornwall is a “world class” tin belt, and South Crofty is the jewel in the crown of Cornish tin mining.”

CUSN is in the enviable position of having a permitted resource and money in the bank: 40.5 million pounds were invested in May 2022. Again, just what you want in a junior resource company getting ready to finish a Feasibility study in the next year and in the process of dewatering the mine at South Crofty.

CUSN’s management is, wisely, investing the time required to come up with a plan to mine tin profitably at South Crofty. It will take another couple of years but the Empress of Tin can afford to wait. As with most juniors, as mining becomes a reality, the share price will be rerated. A lot. 3X is normal, 10X is not out of the question.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment on my overall portfolio. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

We currently own shares in Cornish Metals which we intend to hold but which we may sell at any time.]

How does it compare to players like Alphamin and Metals X ?