The Great Silver Bull

In the comic strip, Peanuts, Linus is convinced that, on Halloween, The Great Pumpkin will appear with toys for all the children who believe in him. Owning silver and shares in silver companies demonstrates a similar faith in another unseen character: The Great Silver Bull.

Silver closed the week a little under $23.50 USD. Is that the Bull at the door?

Unlike the Great Pumpkin, the Great Silver Bull has shown up before: in 1980 silver very nearly touched $35.00 an ounce which would be $126 in today’s dollars, in 2011 silver came close to $48.00 an ounce or $63 inflation adjusted. For silver holders, the return of the Great Silver Bull is the payoff for years of patient stacking and holding.

The Great Silver Bull, when it comes, should drive silver over $50. The question is, how far over $50?

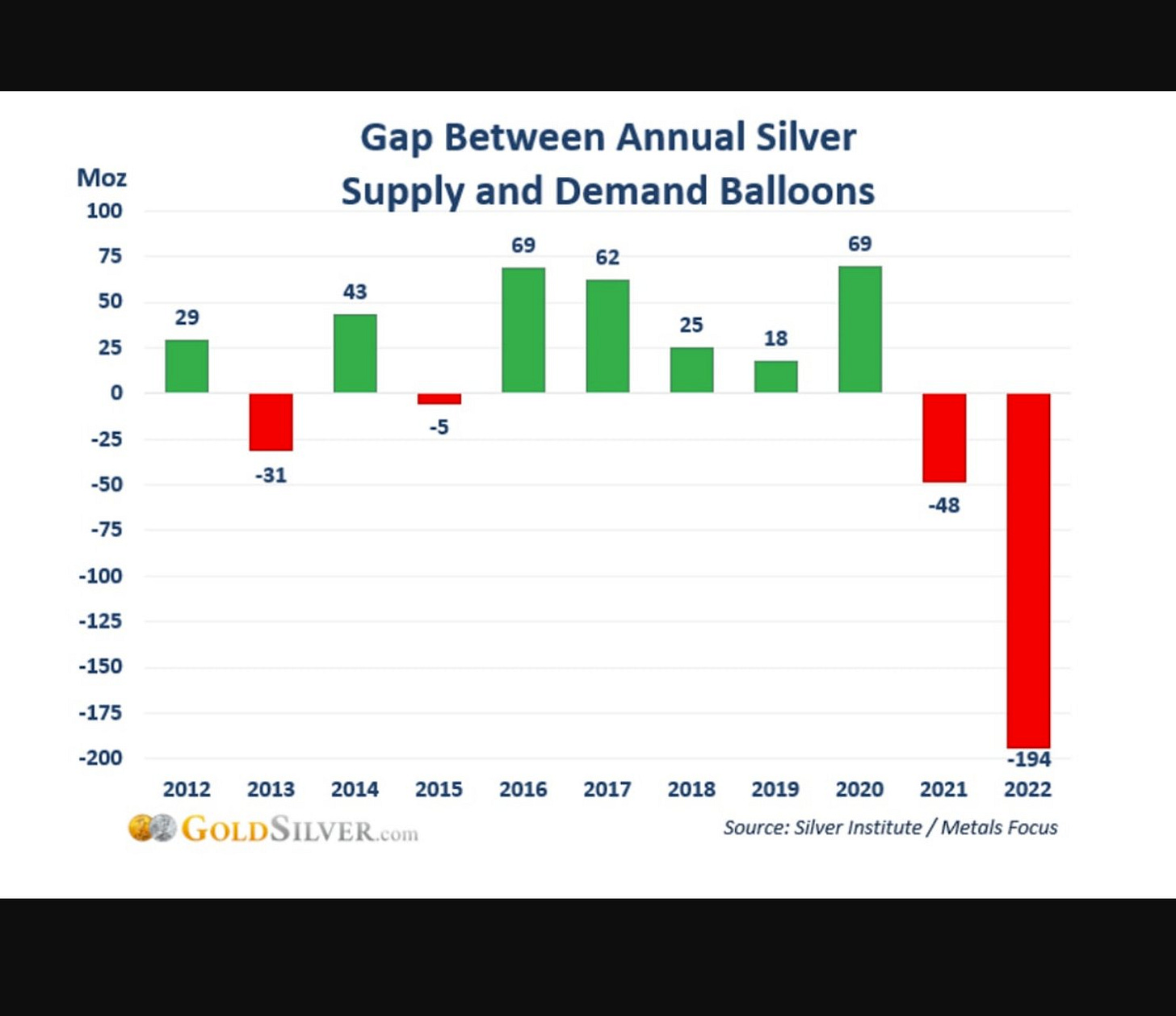

Unlike gold (for the most part), silver is actually consumed and, at current prices, recycled in a limited way. Presently, the demand for physical silver outstrips the production of silver.

The paper silver market is, of course, very liquid indeed. After all, there is nothing easier than selling a paper contract for silver “delivery” in three months or a year knowing that you can “cover” that contract with another contract and trouser a tidy profit. The physical market, on the other hand, has to balance actual supply with actual demand.

The arrival of the Great Silver Bull is not likely to be signalled by the paper silver market with its “spot price”, rather it will be reflected in the premiums dealers charge to retail for silver. A couple of years ago, without looking very hard, I was able to get silver at a premium of $5.00 CDN an ounce, now that premium has risen to well over $10.00 CDN an ounce. What that rise in premium tends to reflect is the dealer’s view of how likely it is that he will be able to replace the inventory. The higher the premium the tighter the “physical” market.

The Reddit gang like to talk about the great #silversqueeze and how silver is the biggest “short” in the world. They may have a point. However, the gap between supply and demand shown in the chart above is more likely to drive the Great Silver Bull.

While people holding physical silver will do well when the Bull finally shows up, investors and speculators holding shares in silver producers, developers and explorers tend to be the big winners when silver goes on an excursion. Companies limping along at $0.05 with $23 silver, become very attractive when silver hits $30 and can hit crazy valuations if silver really goes on a tear. Just as the current low valuations for silver shares make very little sense, when the Bull runs the retail market piles in and share prices go vertical.

The trouble is that it is impossible to tell when the Great Silver Bull is going to run. Worse, the market signals which are sent are, more often than not, false starts. Plus the Bull runs tend to be short and sharp with the silver price going parabolic over just a few months.

Investing in silver and silver shares is an exercise in frustration. Good companies with excellent resources and full production capacity can be locked in the trading doldrums for years. Money spent on physical silver or on silver shares is, essentially, dead money…until it isn’t.

If there is an investment strategy for silver it is something like, “take a bit of money you won’t miss and buy silver shares when they drop in value”. Do this regularly. Be prepared to wait, and wait, and wait. With luck, at some point, the general market will notice that physical silver supply and demand are wildly out of balance and the price of silver will rise. Slowly at first and then like a rocket. Now the investor is faced with a new problem. Where to get off?

It’s a problem we’d all like to have.

I own Bayhorse Silver, BHS.V and Silver Bullet Mines SBMI.V both of which are very, very close to production in safe US jurisdictions. I also own GR Silver GRSL.V which is drilling out a large silver/gold deposit in Mexico. I am down lots on these investments. When the Great Silver Bull finally arrives I expect each of them to go 10x their current price or better.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment on my overall portfolio. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently own shares in the companies mentioned which I intend to hold but which I may sell at any time.]