The Black Art of IP at Bayhorse Silver

Last week I had an interview with Bayhorse Silver CEO Graeme O’Neill. It was about the interesting core extracted at the upper level of Bayhorse Silver’s (BHS.V) underground drill hole. Breccia and elevated levels of copper. I deliberately cut the interview off before we got to what I take as the most significant part of the press release: the IP results.

IP, Induced Polarization, is a marvelous tool for looking below the surface of the Earth. But it is complicated and the results require skilled interpretation. A specialist skill combining geology and physics and not well understood by the vast majority of the CEOs who often rely on it. Even O’Neill. who spent his young years in the New Zealand navy working with radars, radio, sonar and all manner of antenna systems and transmitters has some difficulty with the technology being used today. I knew our conversation would take a while and I would understand all of half of it.

The “bullet” is that the IP at the Bayhorse Mine confirmed a significant area of mineralization at the mine, which was to be expected, and significant areas of suspected mineralization surrounding and below the actual workings. The IP gave O’Neill and his geos a road map of real targets near the Bayhorse mine.

The second, “bullet” is that the IP gave BHS a pretty strong hint of what they might expect to find in the geologically similar areas 5000 feet away, geological spitting distance, across the Snake River at the Pegasus project. “We think it is a proxy,” said O’Neill.

IP is similar to, but very different from the aerial VTEM survey BHS completed early last year. “VTEM is an electromagnetic pulse sent below the surface which can be analysed to provide an electromagnetic survey of the ground flown,” said O’Neill. Effectively, VTEM gives an indication of electromagnetic low resistance anomalies and discontinuities. It provides the outlines of potentially mineralized rock, but it does not tell you much about that rock. It tells you that there “is something there” but does not tell you a lot about what it might be.

VTEM in BHS’s case did a couple of things: first it confirmed that there “was something there” on both sides of the Snake. Second, it prompted additional staking. Third, it gave BHS a generalized target for its first underground hole. Which Bayhorse drilled and was geologically surprised to find they were drilling into copper-bearing breccia. It was elevated copper, smoke rather than fire, and Bayhorse kept drilling 300 feet past the planned bottom of the hole.

But now O’Neill faced a decision. Drill a second “blind” hole and hope for the best, or pause and do a surface and a downhole IP study? BHS went for the study.

“How deep you can survey depends on the length of your “lines”, said O’Neill. “1500 meters on the surface lets you look anywhere from 500 to 800 meters down. With downhole, think of a donut on a stick. You are looking out from the hole out into few hundred meters of rock on all sides. And the donut slides down the stick.”

“You are looking at two, separate, responses to the current. First, resistivity. How well, or badly, does the rock conduct current? Different rocks have different resistivities. Lots of materials conduct current very well, massive suphides, salt water, gypsum,” said O’Neill. “Second, chargeability. Not well understood, but If there is a break in low resistivity rock and then a resumption of that rock, it could be described as similar to measuring a capacitor charging and then slowly discharging.”

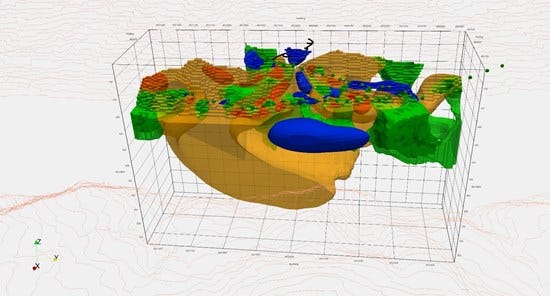

Low resistivity (green in the figure above) suggests the possibility of mineralized material. Chargeability (blue in the figure above) hints that material may have discontinuities. Veins, pods, stockwork, all of which are positive. Exactly what the miners have encountered at the Bayhorse mine.

Then you have to put the information into the wider geological context and match it up with what you already know. “Before the BIG discovery we had always thought that the deposit at the Bayhorse was epithermal and that it went a long way down. The breccia confirmed that thinking,” said O’Neill. “The Bayhorse mine deposit is now known to be epithermal consisting mainly of sulfosalts and as there are many cases worldwide where you get sulfide rich deposits at depth that pass up to sulfosalt rich epithermal at shallower depths. When you see breccia occurrences, it hints at possible massive sulphides, copper porphyry, being found much deeper than the epithermal mineralization.”

Bayhorse is lucky enough to have direct evidence of what is shown in the IP image as the blue blob “Pod” surrounding the mine workings actually contains. It is a pretty solid assumption that most of the surrounding blue blobs (Pods) will show similar structures and mineralization.

“My geos talk about zonation. Where one geological event and another occur in the same overall structure. We know that, historically, at the Bayhorse mine 2 or three pods were mined in very large stopes. There was very high grade silver in tetrahedrite, 15 to 20 feet high. And our current “Big Dog” working is also 20 feet high and up to 30 feet wide. Historic mined grades were up to 240 ounces per ton.”

“While repairing a collapsed section of the mine we have pulled boulders out that we called, for want of a better word, massive sulfosalts, that were totally mineralized, while the main mineralization is all lenses and stockwork,” said O’Neill. “If you look at the IP figure, the mine sits right in the middle of the top blue pod.”

“Now the huge blue blob in the image at depth could be massive sulfosalts, or it could be a massive sulphide copper porphyry,” said O’Neill. “It’s all a little esoteric. You have to look at your geological surroundings and you look at the rock under your feet. But in our opinion, the breccia is a huge signpost that says “here be treasure.” A big or little pot of treasure though, or whether it is signpost to treasure at the Pegasus is what we have to find out.

(Disclaimer: I own shares in Bayhorse Silver which I may sell or by at any time. Graeme O’Neill is a friend. This is not investment advice. Do your own due diligence. Call the CEO.)