Q&A with Graeme O'Neill, Bayhorse Silver CEO

I have been talking to Bayhorse Silver’s (BHS.V) CEO Graeme O’Neill pretty much twice a week, often more, for the last decade. Our conversations are always off the record and O’Neill is very careful not to discuss material information which has not been publically disclosed. As he should be, even with a friend.

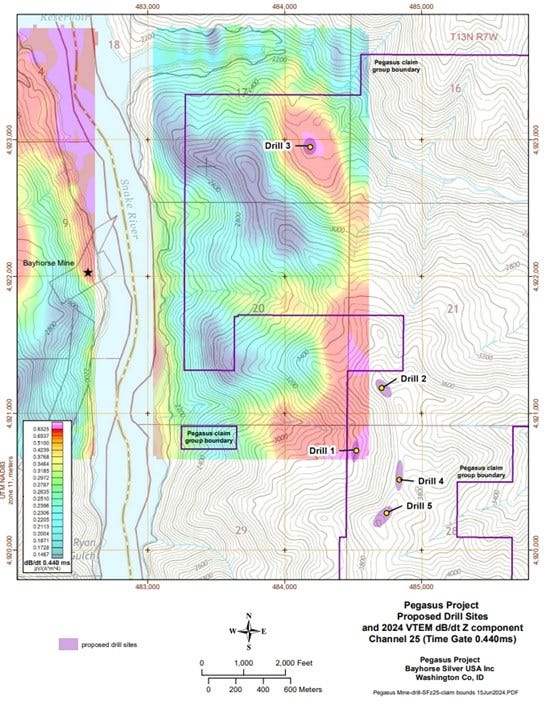

That said, understanding how a CEO is thinking about a company and its plans can be very useful in assessing a company’s prospects. In the wake of the excitement surrounding the Hercules Metals (BIG.V) potential copper discovery, 75 kilometers to the north east, Bayhorse which has similar geology at its mine in Oregon, was transformed into an exploration company. The Pegasus Project is on the Idaho side of the Snake River and is part of an intense staking race along the intersection of the Izee and Olds Ferry terranes. The race was led by Barrick which has staked ground within a mile of the Pegasus Project.

Here’s a map of the staking taken from CEO.CA’s valuable @hogsplus.

Here is the email Q&A I had with O’Neill June 18, 2024, (very minor edits were made for formatting purposes):

JC: Looking at the map of targets in the last press release 3 or the 5 are outside the area covered by the VTEM. How were these selected?

GO: These targets were extrapolated from the 3D model provided from Geotech, that appears to show 1/4, or 1/2 of the actual large signature/target at the south end of the low resistivity trend. If it shows a 1/4 of the signature, and it is round, then it would be about 3,000 feet across, if 1/2, and it is elongated, then the proposed holes should cover both eventualities

JC: Given the terrain and the ground cover it very much looks like a helicopter supported drill program is going to make sense for the Pegasus Project on the Idaho side of the Snake River. I know you have experience with such programs. Can you outline the experience and what that sort of program actually involves.

GO: The Pegasus claims land ownership is a mixture of BLM, Stockraising Homestead (SRHE) where the surface rights are held by private owners, and mineral rights through the BLM, and private ground, (HE) where both the surface rights and the mineral rights are held by the private owner. Permitting approval for access across and onto BLM ground, building roads, drill pads, etc, that is a long drawn out and time consuming, and expensive process. The majority of the targets can be accessed from the SRHE ground, that only requires an access agreement from the owner of the surface rights, and we have those access rights, and once BLM is satisfied we have the access agreement(s) in place, permitting is approved.

So there is a saw off between the time and cost taken to permit roads, drill pads, etc, and place bonds, and the cost of a helicopter supported operation. Mainly the cost of the helicopter flying time.

Bayhorse has conducted heli operations before we acquired the Bayhorse Silver Mine, so we have a lot of experience in such an operation. We have good targets and can support everything from the Bayhorse Mine property, that is only a mile and a half from the Pegasus property. We can use a variety of lower cost per hour helicopters to transport crews and most of the equipment, and costs range from $800, to $1600, to $3100 per hour depending on the type of helicopter used.

Depending on weather conditions, that are normally very good during the summer and fall, then all other costs are normal for any drilling operation. Crews and supplies have to be taken in by helicopter, a fifteen minute flight, rather than a 3 hour truck ride, for example, so helicopters can be very cost effective.

JC: Order of magnitude, what would the five target program cost?

GO: A 3,000 meter drill program can cost, all in, up to $250-300/meter, however, that includes drilling, geologists logging, and cutting and sampling core, and shipping it off for assay, assay costs, and reports, etc. Then there is transportation, food and accommodation costs, mobilization/demobilization, ground clean up, removal of waste, and returning the disturbed ground back to what it was before starting. These costs, obviously, are variable.

JC: Assuming that the money were to be found, how quickly could BHS actually begin drilling?

GO: Within 30 days. We have geologists, drillers, helicopter companies, all teed up, subject to the funding.

JC: Where is BHS on the permitting process on the Oregon side?

GO: We only have one "baseline" study left to do, three groundwater test wells. The well driller is on site with drilling underway right now. It took 12 months from engaging the engineering company to conduct the operation, design the program and get it approved from DOGAMI, the Oregon regulator, to the point where the driller was available. The drilling itself, 3 holes, 2 of 150 feet, and one of 750 feet, should take about three weeks.

Then there is the testing, sampling, water analysis, and final report, that may take as long as 3 months to complete and submit. Once that is done, and subject to anything unexpected, we should be able to submit the final permit application.

JC: What is your take on the results reported from the underground drilling at the BH mine?

GO: We were very encouraged by the results, that gives us greater confidence that we are only scratching the surface of the known mineralization. We are now beyond the original known zones. The VTEM results around the Bayhorse Mine indicate there are two areas of low resistivity, one possibly a large intrusive, ending right under the eastern end of the Mine, and one starting at the western end.

JC: More drilling at the BH mine is not mentioned in the most recent press release. Are you thinking about more holes?

Our geological consultants have always wanted to conduct deep drilling operations under the Bayhorse and if the funds are available, that will occur immediately after the Pegasus drilling. We will conduct downhole geophysics before that starts, to get a better picture of the targets that are presumed by the recent VTEM results and we will be targeting those as well.

JC: What do you think about the current junior market in general?

Junior companies are at the mercy of the current economic environment. When times are good, investors are willing to invest and take a risk. When times are bad, like now, probably the worst I have seen in 20 plus years as a CEO, they are very risk averse. IMO, right now this is as a result of the combination of the aftermath of the covid lockdowns, that few have fully recovered from, horrendous inflation due to governments borrowing and spending so profligately, sucking money from every sector and every person's pockets, through taxes.

Not to mention shutting down sectors of the economy, especially energy, through the insanity of their social engineering and climate policies. Then there is so much uncertainty over trade and the ongoing conflicts in Ukraine and Palestine. So much money borrowed and spent everywhere on crazy, that the world economies are teetering on the brink.

Yet very few politicians understand that to have a vibrant growing economy and social order it needs people and business to have confidence they will be able to profit from their labors. The world needs mining and minerals, and to mine a lot of it. And oil and gas and coal to run industry and farms and to keep us safe and warm through cold winters. Without these there are no phones, no electrical grid, no electric vehicles, no roads, no buildings, no food to feed everyone, no safety for anyone. We will soon be back in the dark ages of the 18th century if common sense does not prevail soon.

I personally am optimistic, and believe that despite the heavy hand of government, common sense will prevail, and good government will return and sanity will resume its rightful place.

JC: Not immediately, but is BHS looking at a succession plan? Is Executive Chairman in your future?

GO: We are always looking at succession plans, and reassessing them often. CEO's come and go, as do Directors and Officers, but companies keep going, and our goal is to ensure there are qualified people to step into any executive role in the company at any time.

(Disclaimer: Graeme O’Neill is a friend and I own shares in Bayhorse Silver and may purchase or sell at anytime. This is not investment advice. Do your own due diligence. Call the CEO.)