Pushing Ahead: Renforth Resources (RFR.CSE)

I have been writing about Renforth Resources for motherlodetv.net for years, Nicole Brewster’s grassroots exploration company with advanced exploration projects in Quebec’s Cadilac Break. Brewster has secured a lot of very prospective ground. Renforth (RFR.CSE) has a promising gold prospect at its Parbec Gold Deposit (next door to the Canadian Malartic Mine). However, the current focus is on its Surimeau property which features polymetalic deposits which can be exposed at surface nickel/copper. More copper than Brewster expected.

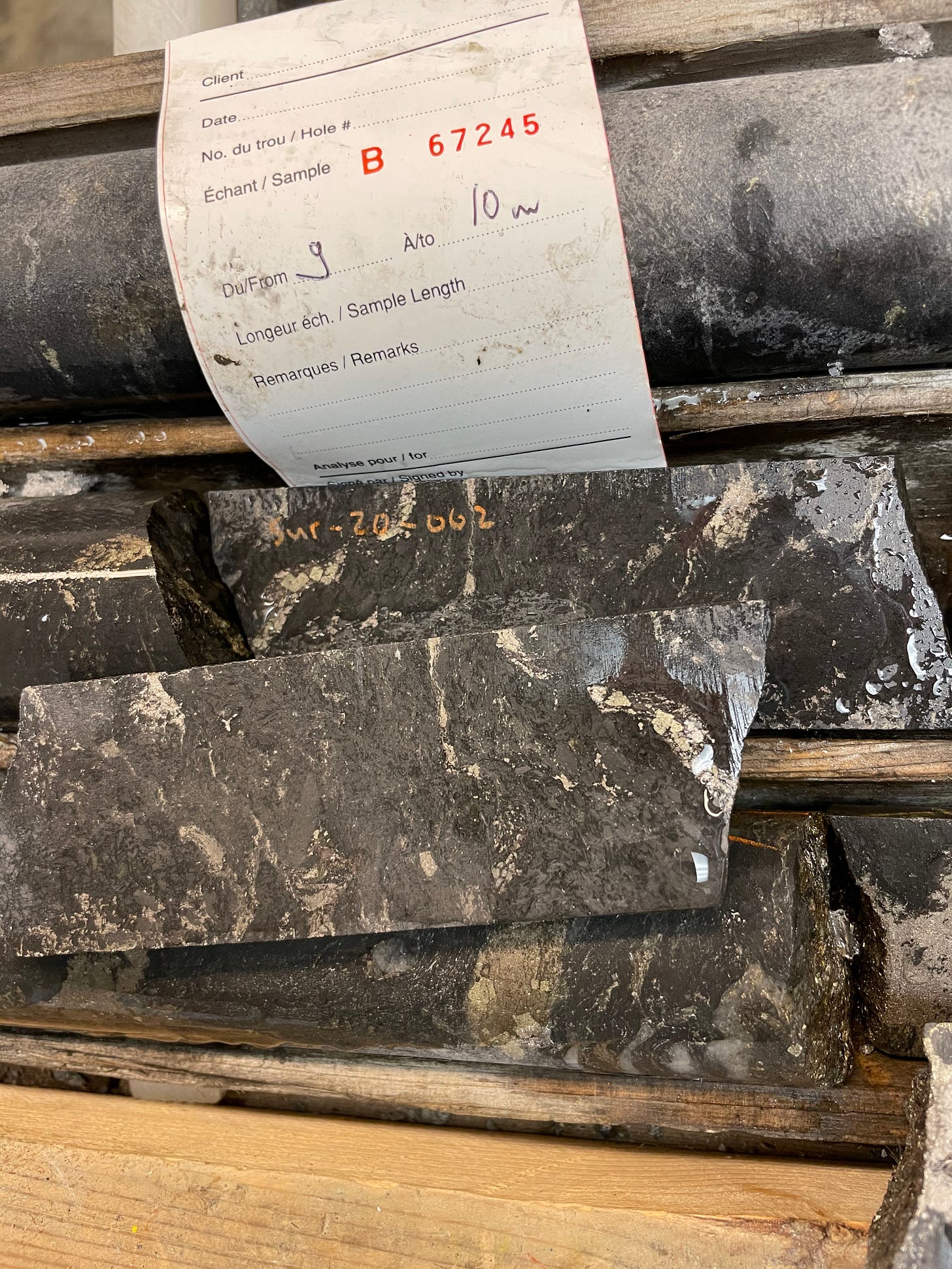

As we are constantly being told, there is an Electric Vehicle surge which already requires more copper and nickel than the market is producing. RFR has what looks to be a 20 kilometer corridor with at least two at surface mineral showings. Every hole it has drilled has hit attractive grades of battery metals. The extensive trenching programme at Victoria West is now matched with channelling and drilling at what RFR refers to as Lalonde. The drilling and trenching confirm the geo-physical data obtained when RFR had the property “flown”.

The remaining results from the drilling at Surimeau should be out in the next few weeks and are expected to be similar to the very encouraging results released to date.

I bought RFR a couple of years ago for $0.03 a share. It surged to a high of $0.10 in Spring of 2021, (I had sold 1/3 of my position in an earlier run meaning that my current holding has essentially a zero cost base). Which is good because RFR is back to trading between 3 and 4 cents despite having advanced work on two, very prospective, properties.

Welcome to the often baffling world of junior exploration companies. The reality is that Brewster and RFR have done everything right, expanded the company’s potential resource base, avoided overspending, kept the share count reasonable (if a little higher than ideal) and made real progress every year. In a rational market, the progress RFR has made would be reflected in an increase in the value of its shares.

In the very strange world of the junior exploration market, the value of RFR’s share is essentially unchanged despite all the work accomplished. Part of this can be explained because RFR has issued shares over the past few years to raise funds but that is not the whole story.

Junior exploration companies are almost impossible to value using conventional valuation techniques. After all, they are producing nothing and costing money every day. Even where a junior has a 43-101 Resource Estimate, its actual value is nearly impossible for the market to assess.

The people who can value a junior exploration company are the highly trained, deeply experienced, geologists and engineers working for larger companies. The fact is that the majority of the most promising junior explorers will either be bought out by a bigger company or vend some or all of their properties to a larger company for development.

What Brewster and her people are doing is putting together the “data” more senior companies require when they look at a piece of ground. The more advanced the work the more “derisked” a piece of ground becomes. The logic of the process means a lot of work is done which the market does not value, until, boom, that work forms the basis of a buyout.

Unlike many other junior explorers, RFR has actually managed to vend one of its projects to a larger company. Back in the Spring of 2020, RFR sold its New Alger gold project to Radisson Mining for cash and Radisson shares. The market paid attention.

Can lightening strike twice? Obviously, I hope so. RFR has two solid prospects both of which have been advanced to the stage where there is enough data for a larger company to do its analysis. Brewster is in no rush to sell.

Even in the currently depressed junior market, selling one of RFR’s projects would certainly bump the share price. How much? Well, the Radisson deal had a potential value of $9.5 million to Renforth and saw RFR shares nearly double in value over the next few months and triple in little over a year. And there were a lot of “contingencies” baked into the Radisson deal which meant the market somewhat discounted its value.

Brewster is under no pressure to sell and, I am certain, will hold out for attractive terms in her next deal. RFR has a current market cap of $11,422,581. Selling a project for $10,000,000 - a nice round number - would, I suspect, cause the market to take a very serious look at Renforth.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO. (Nicole is great to talk to.)

I currently hold shares in RFR.CSE and while I have no plans to sell anytime soon I reserve the right to take profits as they arise.]