NexGen: Uranium in the Athabasca

To really understand the potential of NexGen Energy (NXE.T) you have to take a moment to look at the state of play in the uranium business. A quick tour. (For the long, really long, tour you can’t beat Lea Booth’s Quillette post, The Dawn of Nuclear Energy Abundance published February 9, 2023.)

Long-term, uranium, and the companies which explore for it and mine it, is almost certain to be a brilliant investment. I urge my kids to look for good uranium plays and put them into their TFSAs. Long after I am gone they will thank their crazed old father.

Obviously, the strength of uranium depends upon the strength of the nuclear power industry. It has finally dawned on all but the Greenest that nuclear power is pretty much the only way to generate baseload power without CO2 emissions. As of February 2023 there were 60 new reactors under construction to add to the world’s existing fleet of 440. There are many more in the early planning stages.

The concept of the Small Modular Reactor (under 300 MWe) is gaining traction with Canada as one of the leaders in this new/old nuclear technology. It is a new/old technology because small reactors have been built and operated safely for decades. (Think nuclear submarines.) Now it is a question of how best to build and fuel such reactors for civilian use.

All of this will take uranium. A lot of uranium. Most of the world’s uranium comes from only ten countries with Kazakhstan producing 45% of the world’s supply in 2021. A good deal of the supply of processed uranium comes by way of Russia which, in the present circumstances, presents significant problems.

Supply tightening has, as expected, pushed up the price of uranium so that it is now hovering around USD $50.00 a pound. Which has been very good news for uranium non-Russian producers but has also firmed the market for uranium explorers and developers.

More than a few uranium explorers have been attracted to Saskatchewan’s Athabasca Basin stretching across the northern quarter of Canada’s most rectangular province. The Basin has supplied up to 20% of the world’s uranium production but low prices in the past few years have meant several producers, including Cameco (whose Cigar Lake mine produces the highest grade uranium in the world), have curtailed production.

All of which puts NexGen Energy (NXE.T) in an enviable position. NexGen is presently developing its Rook 1 project which is the largest development stage uranium project in Canada. NexGen has a Feasibility Study for Rook 1 which would place the mine as a Strategic Tier 1 asset. On completion, Rook 1 is expected to produce 29 Mlbs of U308 per annum which would make it the largest and lowest-cost uranium mine in the world.

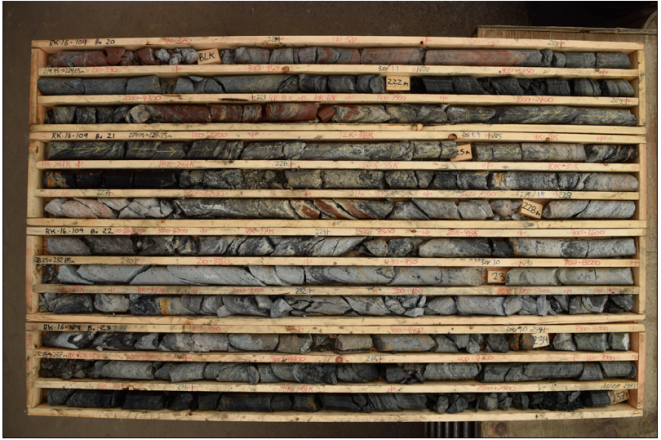

NexGen is also engaged in exploring beyond Rook 1. It just announced its exploration plans for 2023. Up to 22,500 meters of drilling using up to three rigs will systematically test priority conductors that have been highlighted by encouraging 2022 drilling results. Plus, NexGen’s geophysical program will include cosmic ray muon tomography initiated in 2022 on the Patterson Corridor at NexGen’s 100% owned Rook I property as part of Ideon Technologies’ early access program for first implementation of innovative muon detecting instrumentation in boreholes. (And, yes, I had no clue what muon tomography is, however, Ideon Technology has an excellent website where it is well explained.)

NexGen has been a Motherlodetv.net client off and on for years. Annoyingly, I could not afford to take a position when it was trading under $2.00 and have had to cheer from the sidelines as NXE soared to over $7.00 before settling into its current $5-7 range.

As an investment now, NXE offers three big potentials. First, if uranium continues to be in short supply, the price will continue to rise and with it the value of Rook 1 and NexGen. Second, the muon enhanced 2023 exploration program is being undertaken on very prospective ground and has the potential for market moving results. Third, NexGen is on every majors’ short list for either a joint venture or an outright buyout.

NexGen is cashed up with 137 million dollars in the treasury and significant shareholders including Li Ka Shing. Right now it has a market cap just touching 3 billion dollars. that could change very quickly with a surge in uranium prices, a bonanza exploration hole or a JV or takeover offer.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently do not own shares in NXE.T.

NexGen Energy is a Motherlodetv.net client.]