Millennial Potash: Mineral Resource Estimate in Gabon

I last wrote about Millennial Potash (MLP.V) on this Substack a little less than a year ago. The company had completed its transition from a gold explorer to a potash explorer and I interviewed Millennial Chairman Farhad Abasov for Motherlodetv.net at the same time.

Millennial had made the pivot to potash because an amazing property became available in Gabon in West Africa. The Banio Potash Project is a continuation of the Congo Potash Basin. It had been previously drilled and, as Abasov put it in our motherlodetv.net interview,

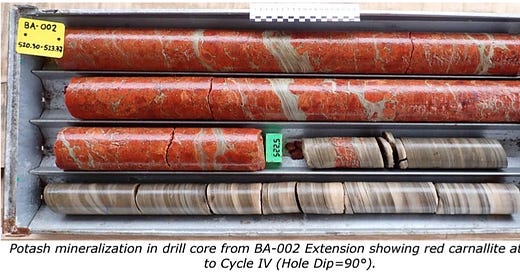

It was first drilled by a French oil and gas company in the 1970’s. They found no oil but intercepted thick horizons of potash. In 2017, an Australian junior exploration company drilled three holes on the property and found potash horizons, thick horizons at excellent grades, starting at a shallow depth of about 230 meters.

Abasov wanted to fast-track the Banio Project and Millennial has managed to issue its maiden 43-101 compliant Mineral Resource Estimate less than a year later. Abasov is quoted in that release as saying,

These substantial resources, with 657M tonnes at 15.9% KCl for Indicated and additional Inferred resources of 1.159 billion tonnes grading 16% KCl, underscores the project's immense potential, considering that only 2 holes have been used in the compilation of the resource estimate. The presence of sylvinite seams constitute a higher-grade resource that adds further promise to the Project and will be explored in future drill programs.

Two holes plus historic data for 1.8 billion indicated and inferred tons running at 15.9% or better is an extraordinary result. However, as Abasov indicates in the release, the MRE covers only a small part of the property and there is more exploration drilling to be done.

With the maiden MRE in hand, Millennial is planning to release a Preliminary Economic analysis in Q1 2024.

The key to the Banio Project is that the potash-bearing seams are thick enough to be “solution mined”. This is a well-understood technique for using a heated brine to extract the potash-bearing material in solution rather than mining the material conventionally. The amenability of the seams at Banio to solution mining will be reflected in the PEA.

At the moment, potash is selling for around USD $330/ton, down from a high of USD $1200 in April, 2022. The indicated potash tons at Banio are 104 million.

From the investor’s perspective, Millennial has confirmed a significant potash deposit. It has a management team experienced with potash and solution mining techniques. The Banio project is in a safe African jurisdiction. If you look at Abasov and his team’s track record, at Allana Potash and later Millennial Lithium, bringing in partners or selling the project completely is very much on the table. A PEA will give the first indication of the Net Asset Value of the Banio Project.

At the moment, potash is selling for around USD $330/ton, down from a high of USD $1200 in April, 2022. The indicated potash tons at Banio are 104 million, inferred adds another 185 million tons. Obviously, there will be CAPEX and OPEX but solution mining, where feasible, is a low cost option.

For fun, imagine that the eventual mine nets, after CAPEX and OPEX, $2.00 per ton: that would be a profit of 578 million dollars. Somehow, I doubt a $2.00 per ton net is very realistic. 10X gets you to $20…You can do the math.

It will be fascinating to see what Net Asset Value will be assigned to Banio in the PEA. I have to expect that it will be several times Millennial’s current 16 million market cap.

Several.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in MLP:V and while I have no plans to sell anytime soon I reserve the right to take profits as they arise. And, at this price, I extended my holdings.]