I spend a bit of time on Twitter. Rots my brain but there are some smart investment people and more than a few junior CEOs. It is a good place to take the temperature of various markets.

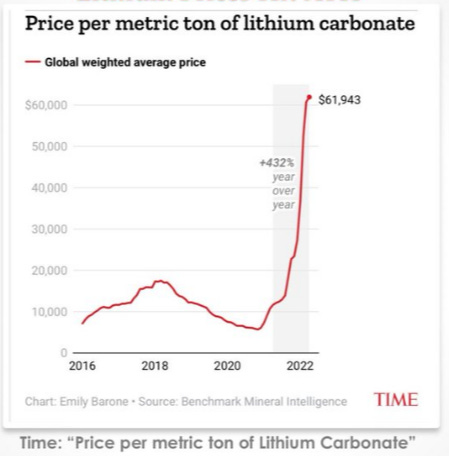

However, Twitter is also a place given to manias. Pretty much every day someone tweets about the “uranium shortage”, “the end of copper”, “lithium to the moon” (it may already be there), “silver squeeze” and “battery metals!!”

Weirdly, none of the tweets are wrong and they may all be right. Metals of all sorts are in high demand and, relatively speaking, low supply.

People much smarter than I am will take deep dives into particular commodities - and often post the link to Twitter - but many of the same issues come up over and over.

The biggest constraint on supply is just how hard it is to find and develop new mines. Most of the world has been pretty intensively explored in the last few decades. There may be a few elephants left - my pal Tom Larsen at Eloro (ELO.V) seems to have found one in Bolivia - but the really huge copper, gold, silver, nickel…have largely been found.

The second constraint on supply is just how much money it takes to bring a decent-sized mine into production. At motherlodetv.net I routinely talk to CEOs who think they will need 300 million, or 800 million and up in CAPEX to bring their deposit to production. (Which is one of the reasons I love stories like NewLox (LUX.V) or Bayhorse Silver (BHS.V) and Silver Bullet (SBMI.V) where a few million dollars puts you into immediate production.)

Big money is cautious money and the sorts of work which has to be done to make a project “bankable” itself costs millions of dollars.

Part of that work is actually figuring out the practical details of mining a particular deposit. There is a huge copper gold deposit at the top of a low mountain in the Yukon. Terrific grades. But one mine plan actually called for a tailings dam which was taller than the CN Tower. And that was just one of the challenges. I have no doubt the mine will happen, but it is a long road to production.

Figuring out the engineering on a mine also provides a basis for costing the build and firms up the expected CAPEX. Details like roads, power, machinery and manpower all go into the mix. They all cost money and that money is spent before a single ounce is recovered.

Of course, there is also metallurgy to be done. What sort of recovery can be expected using what process? The process is a huge part of the design and the cost of a prospective mine.

Add to this the regulatory requirements of permitting and environmental reporting, plus dealing with the needs of people indigenous to area of the proposed mine and the costs pile up.

All of this analysis, design, and testing takes time and, of course, money. Ten years from discovery to production is not at all unreasonable for a large deposit.

Now, apart from the issues specific to a particular mining project, there are general, macro, issues which constrain production. To name a few - the cost of fuel, shipping costs, supply chain issues, lack of properly trained personnel, commodity price fluctuation, geo-political problems, currency gyrations, country risk.

You will often hear people in exploration and development talk about “de-risking” a project. Dealing with the particulars of a project is part of that process, but figuring out how to minimize exposure to the macro issues is another huge part.

My pals on Twitter are not wrong about this year’s lithium price rise or the coming shortage of copper. Where they may be a bit naive is in thinking that a rise in the price of the commodity will fix the supply problem.

Actually bringing new supply online is a long, expensive, detailed process at any sort of scale. Something which, I am afraid, is often lost in the Twitter buzz.