Lucky in Ecuador

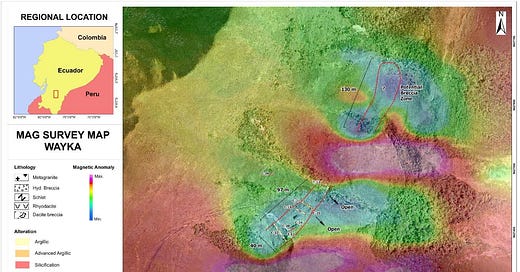

Around a year ago I interviewed Francois Perron, CEO of Lucky Minerals (LKY.V), for Motherlodetv.net. Lucky is in early-stage exploration on ground high up in the Ecuadorian Andes. Working with a rock saw, Lucky is systematically trenching the areas with low magnetic signatures.

As the company explains in its January 17th press release, “The location of this breccia zone which coincides with a magnetic low is significant, even more so by the fact that these breccias do carry gold. The low mag anomalies result from the passage of hydrothermal fluids through rocks which destroy magnetite and cause the low magnetic signatures. The fluids alter the rocks producing alteration zones such as silicification and advanced argillic altered rocks which we have identified in the Kelly breccia zone.”

Lucky’s Wayka Project, part of the Fortuna set of concessions, is relatively inaccessible (Francois Perron wrote this morning to indicate that Wayka was only 7 km from road access, and 15 km from a power sub-station. So not that inaccessible.) which means that makes a lot of sense to do sampling and trenching - relatively low-cost activities - to pinpoint targets which should be drilled. As Perron puts it in the news release, “Through their hard work the team has continued to define more alluring drill targets which we look forward to.”

Given the infrastructure challenges presented by the Wayka project there not only has to be good gold grades, there needs to be a lot of economic rock. What Perron is hoping to prove up is a potential mine on the scale of the five mines with over 3 million metric tons of gold bearing rock within 50 kilometers of the Fortuna concessions including Lumina Gold’s Cangrejos-Gran Bestia mine with 17 million ounces of gold.

Lucky has an ace up its sleeve in the form of an agreement with a very experienced driller who has actually invested cash into the company and concluded a “shares for services” agreement. Drillers are notorious cynics. They have heard all of the brilliant geological theories. It is extraordinary for a driller to invest in a raw explorer. As I said at the end of the Motherlodetv.net article, “Lucky and François Perron may well be sitting on top of an elephant. The driller thinks so and that is good enough for me.”

Lucky shares have spent the last year range bound between $0.05 and $0.09 which is very typical for an exploration company still in the trenching and targeting phase. I don’t expect much price movement until the drill has been deployed and, even then, it will take a while to actually drill the holes and assay the core. Then the fun begins.

The trenching and the mag studies indicate the sorts of alteration geologists like to see. There has been consistent mineralization in the trenches with gold grades running from .3 gpt to over 17 gpt. As Perron states in Lucky’s most recent release, “Mineralization is being exposed and confirms the presence of a large breccia unlike those seen in the structurally controlled feeders of the Discovery zone. Work to date confirms a size of approximately 100 by 40 metres for the breccia. Recent results for the channels confirm that where the alteration is advanced argillic or siliceous there is the presence of gold. The presence of rounded fragments in the breccia is encouraging and could reflect the fact that we are high up in the system.”

The only real way to confirm this geological speculation is to drill it.

My own bet, and the reason I am holding my Lucky shares, is that the Wayka project will turn out to be similar to the massive gold deposits found in the Ecuadorian gold belt. That’s the gamble and it is a gamble an experienced driller has been willing to take.

If the drill results confirm good grades over decent widths, Lucky’s shares will rocket. And, of course, there is always the possibility of a spectacular hole or two. One way or another, we should have a decent idea of what Wayka holds within a few months of the drill(s) being deployed.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in LKY.V and while I have no plans to sell anytime soon I reserve the right to take profits as they arise.]