Lags: Gold, Silver and Junior Resource Companies

Companies Mentioned: Orezone Gold, Victoria Gold, Banyan Gold

Gold is up. So far up that it has hit its all-time high in USD. (And, yes, I am aware that gold is being smoked by bitcoin…but I don’t hold bitcoin. Damnit.) You can find lots of reasons for gold’s rise over at Kitco starting with this rather good overview.

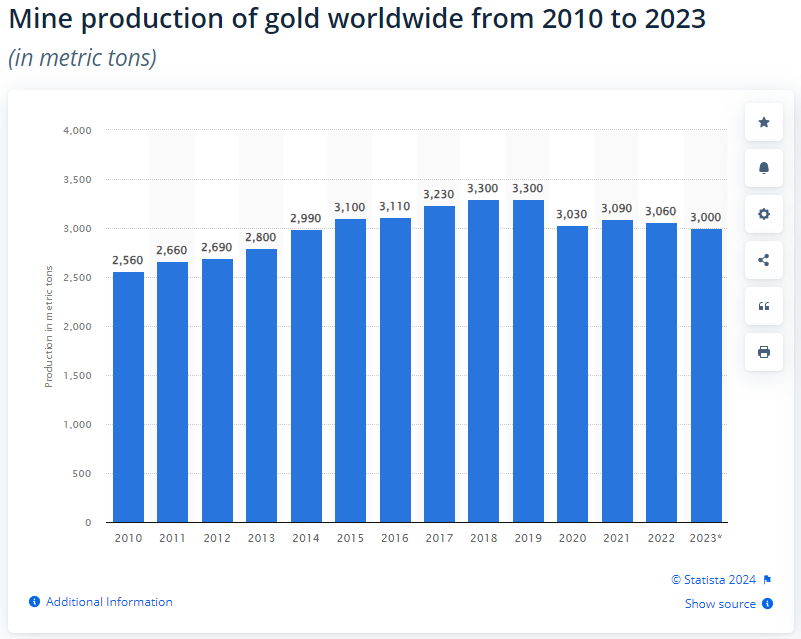

A lot of pixels will be spilt on chin tugging about the “macroeconomic environment”, the “Fed” and geo-politics but a simple supply and demand analysis seems to make the most sense: central banks want to increase their gold holdings, individual investors are seeking the security gold offers, which adds up to lots of demand. Gold production, on the other hand, has fallen a little in the past few years.

Basic supply and demand. However, things get more complicated when we start to look at the performance of the shares of gold producers.

The gold miners index, while it is up a bit in the last couple of weeks is well below its peak in 2020 despite gold being up significantly. What’s up with that? More than a few things but the most basic is that the price of gold is based on gold already “in being”, mined, milled, refined and ready for delivery. Shares in senior producing gold miners reflect the messy reality of mining, jurisdiction, power supply, workers, machine maintenance, head grades and pit designs. They are businesses with a product whose price fluctuates. How the market values gold miners has more to do with their all in cash costs per ounce than with the spot price of gold.

Until it doesn’t.

If you look at early 2020, at the beginning of COVID, the price of gold dipped, but the price of the GDX fell off a cliff. I’d argue that the spot price reflected the uncertainty which hit every market in the face of the COVID hysteria, but the crash of the gold miners reflected the messy reality that their operations were seriously affected by COVID. Everything from having to shut down mines because of COVID outbreaks through to the very real difficulties with supply chains and travel hit every mining company, hard.

However, once the price of gold turned the corner and mining companies put in COVID protocols and realized how much can be accomplished in a Zoom meeting, shares in gold mining companies soared to all time highs. Yes, the price of gold soared as well; but the recognition that gold miners as businesses could and would survive COVID powered their rise.

My general take away from 2020 is that the market values gold producers first as businesses and only after that in relation to the price of gold. The senior gold producers proved that they could weather the COVID storm. Now, that proof in hand, they might reasonably be expected to begin to reflect the increase in the price of their product in their stock prices.

I own two producers, Orezone (ORE.T) and Victoria Gold (VGCX.T) and a pure gold explorer, Banyan Gold, (BYN.V). I wrote about my decision to rotate out of my beloved dividend producer Labrador Iron Ore Royalty and into Victoria and Banyan at the end of November last year. LIF has stayed around $30, Victoria is up $0.25 from my buy price and Bayan is up a full $0.05. ORE.T is down about $0.50 from where I bought it. Not exactly stellar returns and none of these companies has seen much uplift from the price of gold.

My producers are of a similar size in terms of production, Victoria produced 166,730 ounces with All In Sustaining Costs of US$1488 per ounce, Orezone produced 141,425 ounces with AISC of US$1306 in Q3, the last quarter figures have been released for. Each company realized between US$1929 and US$1940 per ounce of gold sold. Gold at just under US$2200 should add $200 per ounce to each company’s bottom line. But it will take the market a while to figure that out.

My own sense is that Victoria will outperform Orezone simply because the Yukon is one of the best mining jurisdictions in the world and Burkina Faso, well, isn’t. In fact, the unrest in the North of Burkino Faso, well away from ORE’s mining operations, has depressed the share price for a year. If gold keeps heading upwards Victoria should rerate to reflect its projected increased production and that price increase. Orezone will, no doubt, benefit, but the benefit may be muted by Burkina Faso’s ongoing trouble.

When the price of gold rises, after a lag, the price of producers generally soars, 2 sometimes 3X is a not outlandish projection. Say $3.00 for ORE and $12 for Victoria. But if the rise in the price of gold is significant enough to “make the news”, the real winners, after a longer lag, tend to be fairly advanced explorers like Banyan.

I won’t claim this is logical but it is rooted in the fact that the producers are businesses which are, to a degree, valued using business metrics. Profit/Loss, balance sheet items: even gold at $2600 adds only a finite increment to the revenues of an Orezone or a Victoria Gold.

A gold explorer, on the other hand, especially one with a recently announced 7 million ounce 43-101 compliant mineral resource estimate, is all about valuing potential in a rising market. Right now, Banyan has a market cap of $101 million or about $14.00 per gold ounce in situ. Given BYN’s location next to Victoria Gold’s operating Eagle Mine, its Yukon jurisdiction, excellent First Nations relations and relatively tight share structure, that 100 million market cap looks low. Very low.

The real effect of gold hitting all-time highs is to swing investor interest back to a precious metals sector which has been largely ignored since 2011. Here’s the chart we’re really looking for:

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in ORE.T, BYN.V and VGCX.T and while I have no plans to sell anytime soon I reserve the right to take profits as they arise.]