Hercules Silver (BIG.V) has been on a tear running from $0.19 in early September to a brief high of $1.25 last week before the announcement that Barrick Gold was taking a strategic position and investing C$23,391,907.

Remarkably, the BIG news sent Bayhorse Silver (BHS.V) from $0.015 to $0.04. So what’s up with that? The Hercules project is 44 kilometers away from the Bayhorse mine, across the Snake River and in Idaho.

Welcome to the world of “closeology”. Or, more exactly, the argument of similarity.

Back in 1925, a geologist named D.C. Livingston published a pamphlet entitled A Geologic Reconnaissance of the Mineral and Cuddy Mountain Mining District, Washington and Adams Counties, Idaho (here is a link to the PDF and thank you to CEO.CA’s Oops). That Reconnaissance spent several pages discussing the similarities between the geology of the then-operating Bayhorse silver mine and various mineralized areas in Idaho including the Hercules claims.

As Oops points out, the Livingston pamphlet is directly cited in the 42-101 Technical Report on the Hercules project.

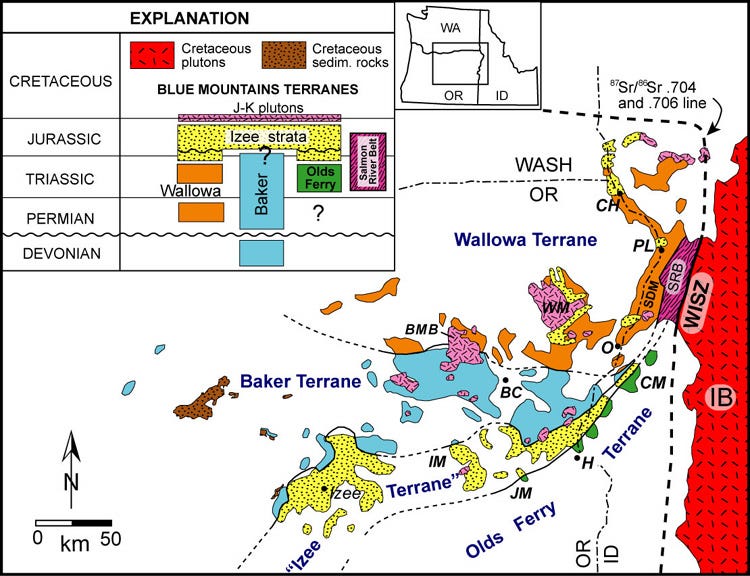

What Livingston seems to have found is a section of an odd bit of geology known as the Izee Terrane which does indeed stretch from Oregon to Idaho across the Snake River (which forms the border between Oregon and Idaho).

The presence of a terrane, which is an isolated fragment of the Earth’s crust sitting on a larger tectonic plate, can lead to mineralization events.

The Izee Terrane is represented by the probable Middle Jurassic Weatherby Formation, the principal host rock at the Hercules Silver Project. The Weatherby Formation comprises volcaniclastic rocks derived from the Huntington Formation and the Baker terrane, and andesite and rhyolite tuff units (p 31, Technical Report for the Hercules Silver Project (PDF)

While the Izee Terrane is not mentioned in the 2018 Bayhorse Technical Report (PDF), both the Weatherby and Huntington Formations are cited as the hosts for the rhyolite in which the Bayhorse silver occurs. And Mr. Livingston and his Reconnaissance make an appearance.

But now the plot thickens. On October 10, 2023 BIG released the results of the first of two “deep” holes it had drilled at Hercules, “the first hole to test a large-scale (>1.8km) blind chargeability anomaly, intersected 185.29m of 0.84% Cu and 111 ppm Mo from 246m to 431.2m, including 45.33m of 1.94% Cu". That was when BIG’s stock began to move. These are excellent copper grades.

At both the Hercules project and the Bayhorse Mine there have been tantalizing hints of copper. BHS’s silver concentrate is shot through with the stuff. But Bayhorse has never done the IP testing to see if there might be a similar blind copper porphyry underlying the Bayhorse Mine silver deposit. Why would it? There is plenty of profitable silver to be mined as it stands.

Delightful as it would be if the Bayhorse Mine sat atop a blind copper porphyry is that a realistic proposition?

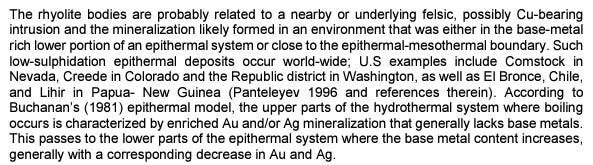

The geos who wrote the 2018 Technical Report considered the possibility:

So both Bayhorse and Hercules have silver contained in rhyolite in Weatherby and Huntington formations and the Bayhorse geos hypothesized that this was related to a nearby or underlying felsic which is possibly copper bearing all underlain by the Izee terrane. Hercules has drilled into its copper porphyry. But, if you look back at Bayhorse press releases you find this:

The initial offtake agreement with Ocean is for the delivery and sale of 300 metric tons or 15 full container loads of silver/copper concentrate production from the Company’s Bayhorse Silver Mine. (Press Release, March 24, 2021)

In fact, the rock at the Bayhorse mine already is showing significant copper credits.

Which means it is not so terribly speculative to think that the Bayhorse mine may be the harbinger of a significant copper deposit. And, given the already large presence of copper in the ore being taken from the Bayhorse, that copper may be close.

Worth a look at $0.04.

[Disclosure: Graeme O’Neill is a friend. I own shares in Bayhorse Silver (BHS.V), a lot of shares, and may buy more or sell some or all at any time. This is not investment advice. Do your own due diligence. ]