I first was interested in GRID Metals (GRDM.V) when I did an interview with GRID CEO Robin Dunbar for Motherlodetv.net when GRID announced that it had raised $8.52 million with the sale of shares, representing 27% of the company, to funds in Australia and the US. It meant that GRID was cashed up to get on with exploring its lithium projects in Manitoba.

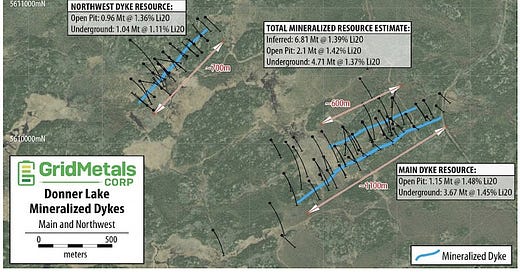

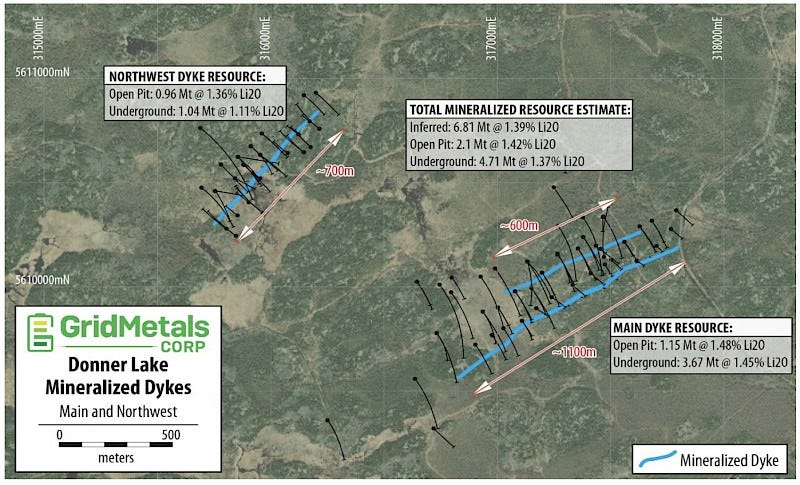

In a July 18, 2023 Press Release GRID declared a 43-101 compliant Mineral Resource Estimate of 6.81 million tons (inferred) grading 1.39% lithium at its Donner Lake lithium project. The stock popped a tiny bit on the news but fell back in this lazy summer junior market.

The release also contained the details of a leasing deal GRID had concluded for the use of a former gold mill, the True North mill 85 kilometers down a road from the Donner Lake property. This is a former gold floatation mill which the Primero Engineering Group, a leading lithium engineering concern and an investor of GRID, will reconfigure to process the lithium material. This requires some permitting however the Government of Manitoba is very committed to bringing on strategic materials.

In the July 18 release, Dunbar commented, "We believe the resource and mill lease announced today are essential building blocks for the development of a lithium production business focused in southeastern Manitoba. Our exploration team has done a great job delineating a significant high-grade initial resource in eighteen months at Donner Lake. We now have a resource at Donner Lake and two potential low capital cost processing options within trucking distance.”

A lot of the frustration in the junior mining game comes from having to wait for what can seem like forever to get from discovery to production. Dunbar and his team, by arranging to use two possible mills (the other being the Tanco Mill 35 km away) near their deposits are committed to reducing that wait.

Obtaining a permit for the initial 50,000 ton bulk sample should be straightforward and the permits to reconfigure the True North Mill should not take that long simply because it is an existing mill with an existing tailings facility.

The market has been very stingy in assessing GRID’s value. Frankly, the company flies far below the radar as it moves from milestone to milestone. That is likely to change and change quickly once a bulk sample permit is in hand and actual mining commences. It will change even more quickly when the trucks start delivering material to one of the mills for processing.

While lithium prices are 50% of their peak, the overall price has rebounded from the May lows. Having a safe, Canadian, source for lithium come online without having to build a mill from scratch is a huge potential bonus.

If the 1.39% lithium grade holds across the bulk sample of 50,000 tons, GRID is on track to produce just under 700 tons of lithium. Spot price of lithium as I write is US $39,527 per metric ton. At a guess, the market will be able to do the math.

GRID’s shares are trading between $0.13 and $0.17. About what I paid for them a little less than a year ago. The move from explorer to producer is very, very rare in the junior mining world. GRID looks as if it will bring that off in record time. At a guess the “re-rating” will be very significant. Very.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in GRDM.V and while I have no plans to sell anytime soon I reserve the right to take profits as they arise.]

Good to know.

With a bit of luck we should both have a Merry Christmas.

just so you know i bought shares in GRID Metals and VPT

thank you for bringing these to our attention