Going Deep: Data Dive from Bayhorse Silver

Junior resource companies rarely release all their data. They often have “data rooms” where meter by meter drill results and layered geo-physical data is made available to significant players - potential institutional investors, joint venture partners, acquirers - who have signed non-disclosure agreements. After all, retail investors can’t be expected to have the skills, the education, the expertise to correctly interpret complex, technical, information.

Graeme O’Neill, CEO of Bayhorse Silver (BHS.V) has always done things differently. Rather than drilling a few hundred holes at the Bayhorse Mine, O’Neill has built out a mine complete with ore sorter and a mill over in Idaho. Drilling has been largely confined to figuring out where the miners should go next. BHS does have a 43-101 compliant resource estimate of an Inferred 6.3 Million Ounce Silver Resource which is outdated and does not reflect what the miners have actually found.

Back in October of 2023, Hercules Silver (now Hercules Metals) (BIG.V) hit what looks to be a copper porphyry at its Mt. Cuddy project 75 kilometres down the Snake River in Idaho. Right at a suture of the Izee and Olds Ferry terranes. BIG’s share price soared and BHS popped on the similarity of the geological structures. O’Neill took advantage and raised a million dollars which was promptly invested in a VTEM survey of both the Oregon and Idaho land adjacent to the Bayhorse Mine. The BHS billy goat was dispatched to stake ground on both sides of the Snake. (Just in time as Barrick was staking ground from Mt. Cuddy to within a mile of the Bayhorse ground in Idaho.)

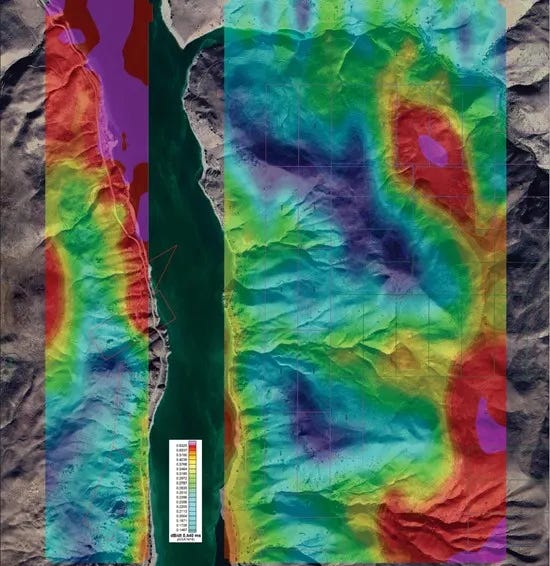

Bayhorse released various maps of the “resistivity” and “magnetic” signatures recorded in the VTEM overflights.

I wrote about the “blobs” as the material was released. But it was less than satisfying as the maps and diagrams were, effectively, summaries of the VTEM information. Good in themselves, but lacking a lot of useful detail.

Now Bayhorse has posted to its website a great deal more information about the VTEM results. Information which most companies would not release except in a data room with NDA’s in place.

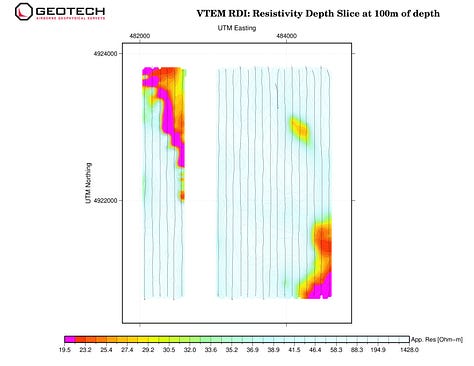

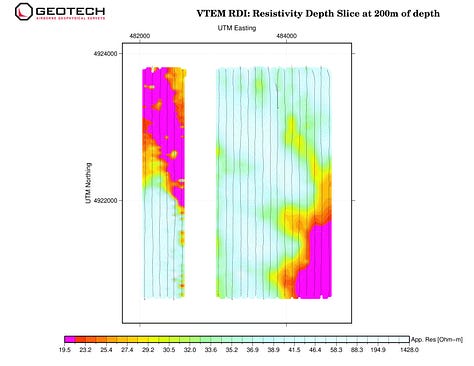

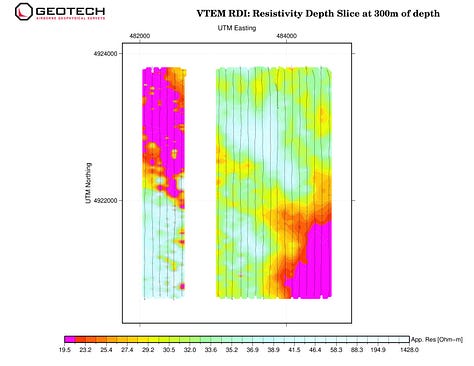

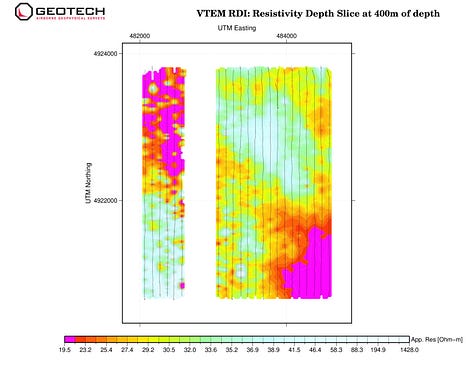

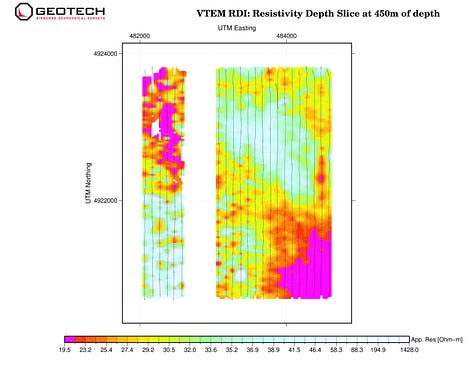

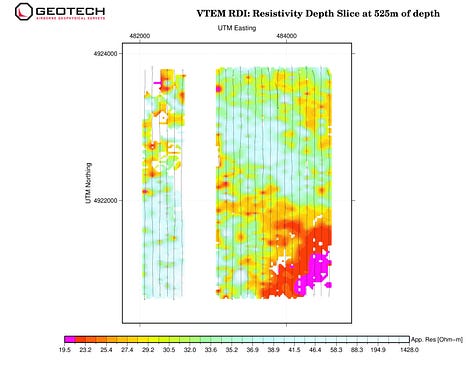

There is a lot of information linked from that page. Most of it, frankly, flies right over my layman’s head. I was, however, intrigued with a set of data which provides VTEM RDI: Resistivity Depth Slices at 25 meter intervals. (PDF)

The basic theory is that the lower the resistivity the more likely there is to be metal in the rock. Basalt is a terrible electrical conductor, sulphides of gold/silver/copper are very good conductors. (In his early working life, O'Neill specialised in electronics and electrical and very clearly understands that low resistivity material = high conductivity material) (Cautionary note: salt water is also a good conductor.)

It is very worthwhile to scroll through the entire PDF which goes down to 575 meters. However, a couple of things struck my untrained eye:

These are a little tough to read, they are the RDI slices every 100 meters and then an additional 50 and then 75 meters. The white band in the middle is the Brownlee Reservoir on the Snake River and the boundary between Oregon and Idaho. On the left is the Bayhorse Mine, on the right the new ground BHS has staked in Idaho. (Note: not all of the Bayhorse ground was flown. The BHS billy goat used the VTEM results to stake additional land to the east.)

Highly trained geologists and geo-physicists can get a lot more from these slices than a layman can, but simply eyeballing the Resistivity Slices gives you a sense of what Bayhorse is looking at.

On the left hand side, which is the Oregon side and which starts at the Bayhorse Mine itself, beginning at 100 meters there is an expanding area of low resistivity as you head northwest. It is apparent at 100 meters but expands encouragingly at 200 and 300 meters before fading away at 450 meters.

The question is what material is causing the marked drop in resistivity. At the Bayhorse Mine it is largely silver with a decent copper credit and what are described as “wiffs”of gold. A good assumption in eyeball geology is that mineralization tends to be similar where the structures are similar. The Bayhorse Mine sits at the very edge of the newly discovered low resistivity corridor and a larger drill could be deployed underground to test the mineralization, if any, present both along strike and at depth.

Looking at the slices, underground drilling (which does not require additional permitting), could produce important results from relatively short holes. Scissor holes of say 300-400 meters could test the resistivity anomaly independently of the drilling on the Idaho side. Underground drilling can take place year-round and need not be massively expensive.

On the Idaho side, the slices are equally encouraging, particularly in the south-eastern corner of the VTEM covered ground. Unlike the Oregon side, Pegasus is looking for a “blind” structure, ideally a copper porphyry. The low resistivity is covered in roughly 100 meters of barren Columbia basalt.

Magnetics have shown other targets on the Pegasus ground but Bayhorse’s focus is the south eastern blog. A five hole drill program has been planned and budgeted. Realistically, it is a program Bayhorse has the expertise to conduct with contract drillers and a helicopter facilitated logistics operation. But it all comes down to money.

It is well worth reading the Q&A I did with Graeme back in June. Graeme is both an optimist and a realist. He wants to get the Pegasus Project drilled and he wants to look at the anomaly which extends off the Bayhorse Mine itself. Now it is about ways and means.

The ground around the Bayhorse Idaho claims has been staked, mainly by Barrick. But the ground Bayhorse has staked and flown VTEM over is further advanced than the essentially “greenfield” ground other companies have staked along the Izee/Olds Ferry sutures. A company wanting to have exposure to what may be a major US Copper discovery could do far worse than making an arrangement with Bayhorse to jointly explore the Pegasus Project.

Now that this detailed data is online, you have to think Barrick - having a claim butting right up to BHS’s claims - and others, like Rio Tinto or Bob Friedland - will be looking very carefully at this new disclosure.

(Disclaimer: Graeme O’Neill is a friend and I own shares in Bayhorse Silver and may purchase or sell at anytime. This is not investment advice. Do your own due diligence. Call the CEO.)