Eloro (ELO.V) The Big Guns have arrived

Strategic Advice from the Chairman of Yamana Gold, Peter Marrone

I just increased my position in Eloro (ELO.V).

Over at my day job at motherlodetv.net I did a short write up about the appointment of Yamana Gold’s Executive Chairman, Peter Marrone as a special advisor to ELO.

My rule over at motherlodetv.net is to provide information, be objective and keep my speculations and opinions to myself. It’s a good rule and has served motherlodetv.net well. But it prevents me from saying,

THIS IS HUGE!

Tom Larsen, ELO’s CEO and I go back a long way. He was my baby broker when I was a completely crazy baby investor. It worked out well. Larsen has been around the exploration and development markets for decades and has done very well. He has a very good idea what it takes to launch a billion-dollar deposit. (And that is a conservative estimate.)

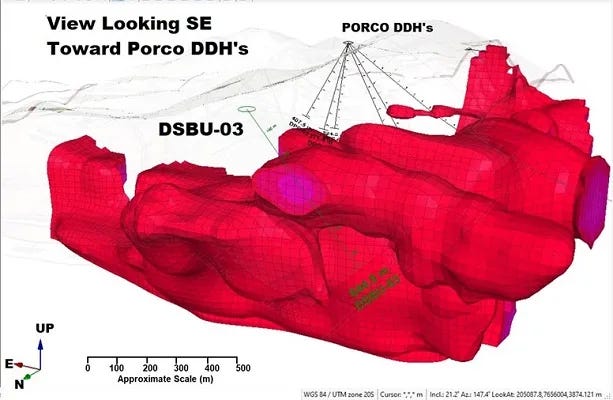

Iska Iska is a Bolivian silver/tin deposit the size of which is both somewhat unknown and staggering. Larsen said to me in a motherlodetv.net interview, “At the end of the day we may have a billion tons of commercial material.”

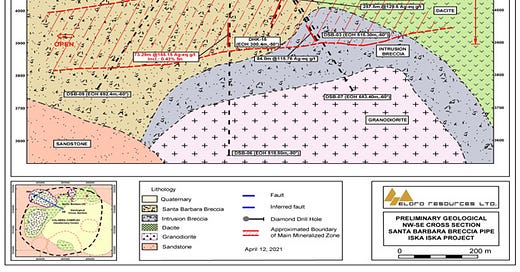

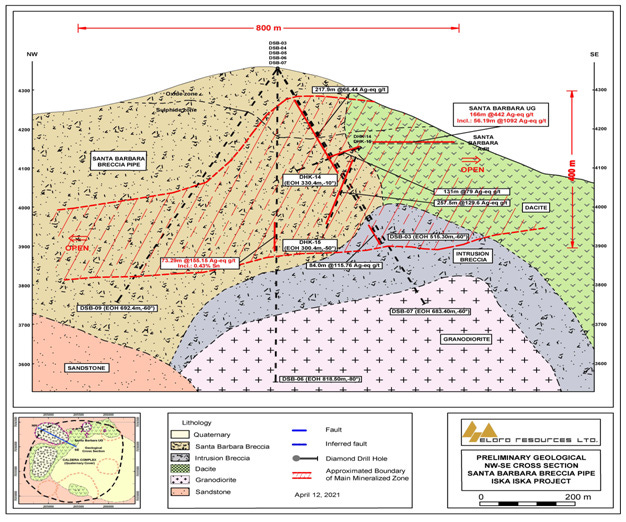

The deposit is so large that Eloro refers to part of it as Domain 1, a silver epithermal system, which may run to 400 million tons of 160 gpt silver equivalent material. In itself, that would make a mine.

Domain 2 is below and deeper than Domain 1 and contains what Eloro is rapidly defining as a massive porphyry-epithermal silver-tin polymetallic mineralized system. It’s big and the tin grades are significant and improving the deeper Eloro drills.

Larsen already has an all star team working on Iska Iska. Led by Sr. VP Exploration, William Pearson and run in Bolivia by Dr. Osvaldo Arce, who literally wrote the book on these sorts of systems in Bolivia, and bolstered by star geologist Quinton Hennigh, ELO has the geology sorted. There are drill rigs turning both at surface and underground. Hennigh pointed out that there has not been a drill hole which has not hit mineralization.

Which is why the addition of Peter Marrone, at this still early stage, is huge. Marrone has been a corporate lawyer, an investment banker and the Executive Chairman of Yamana Gold, a Tier 1 gold mining operation which is currently being taken over by Gold Fields Ltd. in a 6.7 billion dollar transaction.

Larsen is well known and well respected in junior mining circles. People take his calls, people call him. There are several large companies sniffing around Iska Iska. Bringing in a big gun is a great move.

It is a pretty safe bet that Eloro knows it does not have the expertise to fully develop, much less mine, a billion ton deposit. Eloro is an explorer.

Size Matters

On the back of an envelope you can write down 500,000,000 tons and then 4 pounds, which is what tin intervals at Iska Iska have graded at, and then the current price of tin USD 15.80 per pound. You get this really silly number: $31,600,000,000. Yes, that is 31 billion dollars.

And that is just the tin.

For scale, Eloro’s current market cap is $224,650,000.

In today’s press release announcing his appointment, Peter Marrone stated, “Simply put, Iska Iska is a world-class project and I look forward to helping management to increase value for Eloro shareholders.”

Given the size of the deposit(s) that shareholder value is going to increase. However, having an Advisor of Marrone’s experience, connections and capital markets savvy, will maximize that increase.

Larsen was smart to find Marrone, but brilliant to bring him in earlier rather than later. This appointment strongly suggests that Iska Iska could be in play sooner rather than later.

I am searching the couch for a bit more money to put on the table.

Update 06-07-22: I love it when this happens. I put a Market Order in last night and was filled at $3.47….ELO.V closed at $3.80. Too bad I could not buy 10X the shares but there was only so much change in the couch.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in ELO.V and while I have no plans to sell anytime soon (actually I am buying), I reserve the right to take profits as they arise.]