Eloro (ELO.T) put out a news release which the retail market treated as a disappointment. I suspect because retail is fixated on the promised, but late 43-101 Mineral Resource Estimate, now slated for late August.

The news release was all about the tin at ELO’s Iska Iska property. The company has already established that there is a significant tin element at Iska Iska but there were open questions as to how that tin could be mined and processed economically.

In the release, Mike Hallewell, C.Eng, Eloro’s Senior Strategic Metallurgist comments: “The level of metallurgical and pyrometallurgical work that has been conducted thus far at Iska Iska is exceptionally high for an inaugural MRE but is justifiable due to the significance of this large potentially open pittable tin and polymetallic resource. This additional metallurgical/mineralogical knowledge will enable Eloro to rapidly move towards a preliminary economic assessment (PEA).”

Iska Iska has always been two distinct challenges: the silver/polymetallic deposit on the one hand, the tin play on the other. At a guess, the silver piece is not metallurgically complicated and the anticipated recovery will be similar to other Bolivian silver mines. But the tin presented a puzzle.

The news release provided updates on two elements of the mining issues at Iska Iska. The first is the question of the “amenability” of the rock from both the Polymetallic Domain and the Tin Domain to the German company TOMRA’s XRT ore sorting process. Ore sorting allows a miner to discard rock below the cut off grade before it is taken for further processing and directly affects the economics of a mine. The results at Iska Iska were very encouraging:

“ the preliminary indications are at least 40% of the run-of-mine (ROM) polymetallic mineralization could be rejected as waste while for the Tin Domain, as much as 80% of the weight can be rejected as sub – cutoff grade (COG) waste. Ore sorting will significantly increase concentrator feed grades which will enhance concentrator recovery in both domains. In addition, bulk mining techniques can be employed without resultant dilution issues and this will reduce downstream processing costs.”

As the release points out, “much of the mineralization in both domains occurs in veins and vein breccias”. It is useful to think of a layer cake on its side with multiple bands of icing being the veins. If you have good ore sorting results you can take a slice of the cake, run it through the sorter and be left with mainly the icing.

The other question was how much tin could be recovered from what the press release refers to as the “low grade” tin domain and by what means. Samples of the tin bearing rock were sent to Cornwall, one of the premier tin mining districts in the world, where they were run through gravity separation and then ground further and processed by floatation. The recovery was 50% using this flowsheet.

Other samples were sent to University of Oruro in Bolivia. Here pre-concentration techniques including Dense Media Separation (“DMS”) using heavy liquids were tested. The results were encouraging as they matched the XRT ore sorted results of being able to discard 80% of the material as below cut off grade. The great advantage of DMS is that it can deal with sub 10mm “fines” which are too small for the XRT sorter.

What was confirmed in these tests is the potential viability of the large, low grade, tin domain.

What interests me as an investor in ELO is the fact that management has undertaken this level of testing. This level of testing is often left to the Preliminary Economic Assessment phase of the 43-101 process. It is unusual, to say the least, at the Mineral Resource Estimate stage.

In the release, Tom Larsen, CEO of Eloro, said: “These positive metallurgical tests, particularly the “Ore-sorting” tests at TOMRA, have a major positive impact on the potential future production at Iska Iska. For this reason, and in consultation with our independent consultants, Micon International, we deferred completion of the inaugural MRE until these tests were completed and the results could be fully incorporated into the final MRE which is now expected to be released in latter August.”

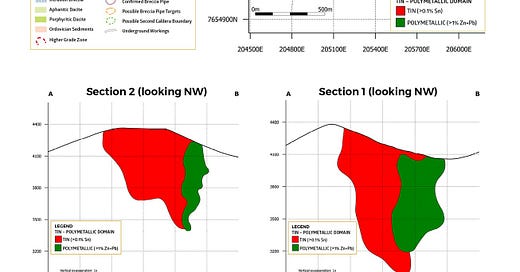

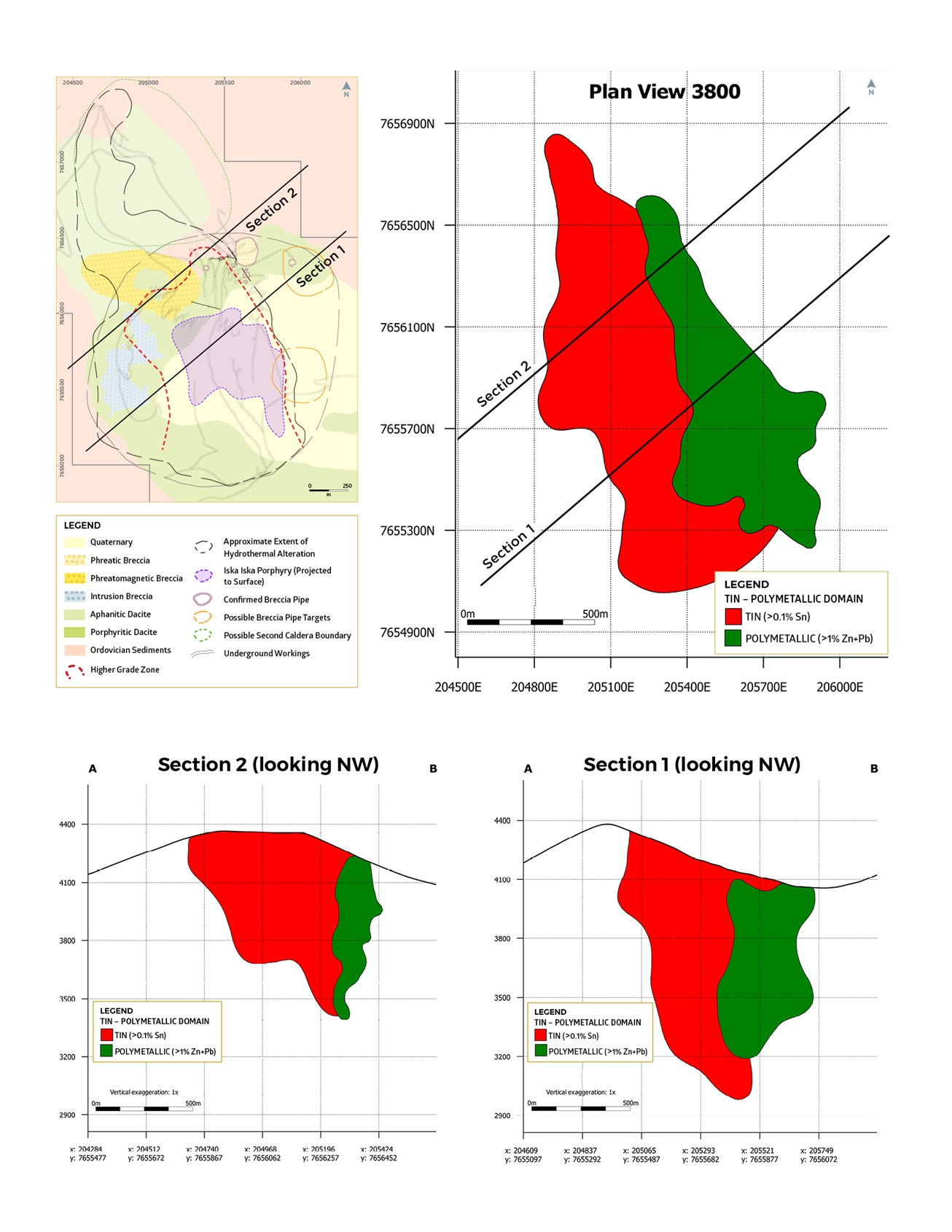

Effectively, the positive results for the tin domain means that Iska Iska has the potential for two mines, tin and silver polymetallic. A reality which is illustrated by the figure included in the press release and posted above.

Now, as a matter of pure speculation, it would not surprise me at all if the ore sorter analysis and the recovery analysis were added to the process to answer third party questions prior to the release of the MRE. Realistically, the mining BigCos who are potential buyers for Iska Iska have been plugging the drill results into their own models for some time. They have a pretty good idea of what the MRE is going to disclose in terms of the size of the deposit. What no one knew was what the tin recovery would look like and how well the low grade tin deposit could be concentrated. Now there is at least a preliminary analysis and that box can be ticked on the due diligence check list.

I would expect developments will move quite quickly now. The MRE, if it suggests a decent deposit size will be the starter’s gun for what may be a very short race to billions.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in ELO.V and while I have no plans to sell anytime soon (actually I am buying), I reserve the right to take profits as they arise.]

My pleasure. This is a great story and I have to think it will only get better. Likely way better.

thanks for the update