Dr. Copper will see you now

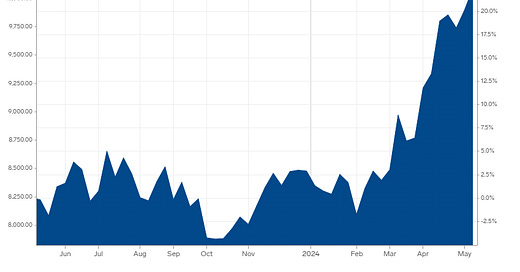

Copper seems to be heading to all-time highs as I write this in mid-May. Demand is exceeding supply and is forecast to continue growing for years. Stanley Druckenmiller, always referred to as “the legendary investor”, said in an interview,

"Copper is a pretty simple story, takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions. These missiles all got enough copper in them and the world's getting hot that we just think the supply-demand situation is incredible for the next five or six years,"

I suspect he’s right. But how to play copper in the junior resource space? While copper producers are certainly worth a look, at best they will go 2x and where is the fun in that?

There is, of course, much excitement surrounding Hercules Silver (BIG.V) and, indeed the whole Izee Olds Ferry terrane suture. Drill speculation is a thing. But, realistically, BIG is at least a decade and 500 million dollars (minimum) away from actually producing copper. Right now, it is a drill play. One which could pay off brilliantly if they manage to hit 1%+ copper but a very long way from production.

There are plenty of other explorers including my pal Peter Bell’s Kermode Resources (KLM.V) with decent copper chances. What I have been looking for are under-the-radar potential near-term producers who can catch the current wave.

Regular readers will know I have found two companies which hit that mark: Canadian Critical Minerals (CCMI.V) and Intrepid Metals (INTR.V) which put out drilling results on May 14.

A key thing to note about many copper projects is that along with copper many have gold and silver credits. Those credits can make a huge difference in the projected profitability of a project. Very much something to keep an eye on when reviewing results. The other thing to bear in mind is that copper content is measured as a percentage whereas gold and silver are measured in grams per ton.

CCMI, unlike BIG or INTR, is actually producing copper. At its Bull River mine near Cranbrook, BC, CCMI has a 180,000 ton stockpile of previously mined material. It has crushed and screened around 40,000 tons of that and has an ore purchase agreement with NovaGold (NG.T).

CCMI put out a press release on May 14.

During the month of April 2024, the Company trucked 362 wet metric tonnes ("wmt") of mineralized material to New Afton and the Company received a provisional payment of approximately US$72,445 for the April shipments. The mineralized material sent to New Afton graded 2.96% Cu, 0.62 g/t Au and 23.1 g/t Ag.

It also stated that it had only resumed trucking operations on April 24 which means it trucked 362 wet metric tonnes in 6 days and made $72K. Call it 60 tonnes a day. Multiply by 20 working days in a month. 1200 tons. 72/6=$12,000/day. Times 20 is $240,000 a month.

Now, consider that the Steinert KSS 100 X-Ray Transmissive Ore Sorter can sort 40 tonnes of rock per hour and you can see the terrific upside potential for CCMI. In the release, CCMI states that “we are still seeing grade improvements of over 200% for all metals using the ore sorter” which means that, effectively, 60% of the rock is being rejected and the grade improved. I did the calculation nearly a month ago,

Back of the envelope, if CCMI can ship 1000 tons a month of sorted rock the gross value of the rock shipped would be $136,000. But I have to bet that CCMI will be more ambitious. The ore sorter can process 40 tons an hour. A 10 hour day sorts 400 tons of rock and if you use the 250% copper upgrade number it implies that around 240 tons of rock are discarded with 160 tons of the sorted rock being shipped. Running the sorter five days a week would produce a shipable 3200 tons a month. Triple the current volume.

I am boringly old school. I like companies which make money every month in cash. I like companies which are producing copper, gold and silver. I suspect when the market clues in, CCMI will be re-rated as, at least, a copper development story. But it really should be valued as an actual copper/gold/silver producer because that is exactly what it is doing.

Intrepid Metals also had a release out on May 14. It is very much still a “drill show” but the results are very encouraging. “72.20 Meters of 1.28% Copper Within 198.00 Meters of 0.68% CuEq”. Woot! But here’s the thing, “from 10.00 to 208.00m”. Those grades are, practically, at surface.

Hercules Silver exploded when it hit 1.94% CU at 246 meters down. Intrepid has slightly lower grades of copper and significant gold starting at 10 meters. BIG has serious IR and public relations capacity. The drill speculation has already made me money on my trading position. But, realistically, 246 meters to get to the ore is a lot of meters. INTR has good grade from very near surface.

Drunkenmiller quoted above says with some authority that it “takes about 12 years, greenfield to produce copper” but that may not be true for INTR. Its Corral Copper Project in Arizona has been the site of several small copper/gold mines and there are 50,000 meters of historical drilling. If Intrepid can prove up a decent sized, near surface, potentially pitable, copper gold resource and publish a 43-101 Mineral Resource Estimate in short order, 12 years might become three years or less. Or, alternatively, the project could be sold or joint ventured or a strategic partner might come in.

For both Canadian Critical and Intrepid a rising copper market is nothing but good news. World renowned miner Robert Friedland’s Ivanhoe Electric just annouced a partnership with BHP to deploy the proprietary Typhoon ground penetrating technology to search for copper and other critical minerals in the US. The search for copper is shifting into high gear and both CCMI and INTR will pop up on investors’ radar sooner rather than later.

[Disclaimer: I hold positions in KLM.V, BIG.V, CCMI.V and INTR.V which I may add to or sell at any time. This is not investment advice. Do your own due diligence. Call the CEO.]