Defence Metals: On my screen

I have been following the progress of Defence Metals (DEFN.V) for a few years. The company has a rare earths project in British Columbia which it has been steadily advancing.

I had a brief chat with the company at VRIC where they had an excellent display. However, the company’s shares after a brief run to over $0.60 in February 2021, have been range bound between $0.20 and $0.35 for the past 18 months.

Which is odd because Defence has put out a string of positive drill results and has reported excellent metallurgical results.

So I go back to a quote from Bob Moriarty of 321Gold.com back in December 2019 at motherlodetv.net,

“No one understands rare earths. First of all, they aren’t rare and like 99.999% of ordinary people, I couldn’t name two or three of them if my life depended on it. We use them, we need them, China pretty much controls the market on them. That’s it, that’s all I know and I know more than most.”

I am hoping to do an interview with management at Defence Metals for Motherlodetv.net in the next few days. With luck, I’ll have a better idea of where Defence is on its journey towards building a mine.

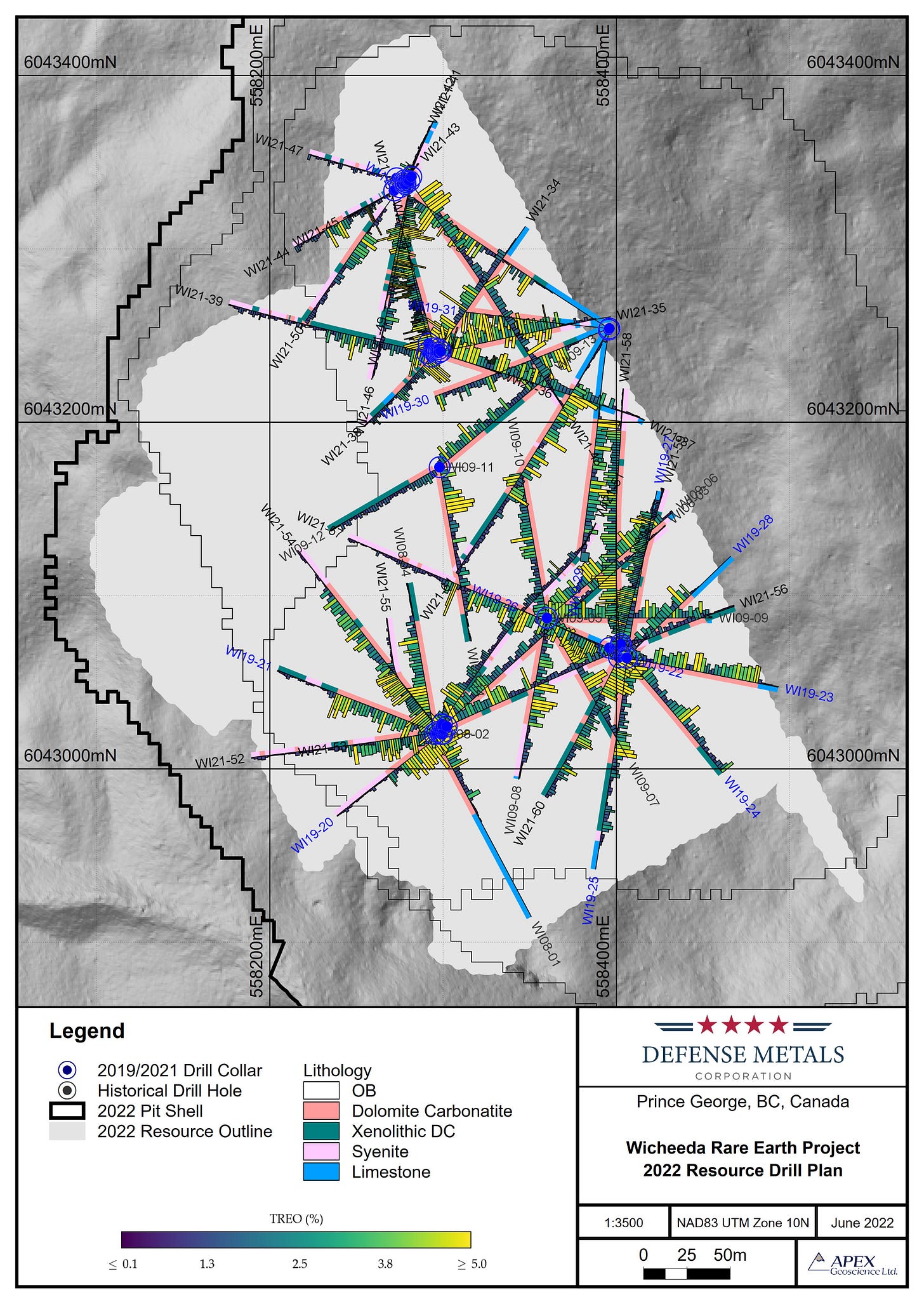

The investment case for Defence and its Wicheeda property has been strengthening since Moriarty confessed his lack of knowledge. The company has an updated 43-101 Resource Estimate with a a 5.0-million-tonne Indicated Mineral Resource, averaging 2.95% TREO, and a 29.5-million-tonne Inferred Mineral Resource, averaging 1.83% TREO. It has a PEA indicating “a pre-tax net present value (NPV) of $761 million, and after-tax NPV of $517 million, at 8% discount rate. The pre-tax internal rate of return (IRR) is 22%, and the after-tax IRR is 18%.”

Compare that with Defence’s current market cap of 68.5 million dollars and this looks like a very good opportunity indeed.

Defence announced that it is setting up to do a Pre-Feasibility Study and that it has hired a Project Development Co-Ordinator with 40 years experience in mine permitting, operations, and project management.

Building a new mine is always challenging. However, Defence enjoys one huge advantage: there is a huge push on in the US to find non-Chinese supplies of the rare earths which are critical for most of today’s most important technologies and products. Everything from Electric Vehicles to wind turbines to fighter jets needs rare earth products. (For an excellent backgrounder on the strategic challenge of rare earth supply chains take a look at The Diplomat, “Rare Earths: Fighting for the Fuel of the Future”.)

I do not currently own shares in Defence Metals. That may change after I have spoken with management. Like many investments, it is a question of “entry point”. The Defence Metals shares will be re-rated when the market is confident that a mine will be built. That 68.5 million market cap will go up…a lot.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently do not own shares in DEFN.V.

Defence Metals is a Motherlodetv.net client.]