Credit Suisse: Silver, Physical and Juniors

Over on Twitter, the astonishing rise of Credit Suisse Default Swaps is being touted as the “next shoe to fall”. Unlike Silicon Valley Bank and Signature Bank, people have actually heard of Credit Suisse. It is, in fact, a Globally Systemically Important Financial Institution (so says Master of the Universe, Mark Carney), commonly referred to as “Too Big to Fail”.

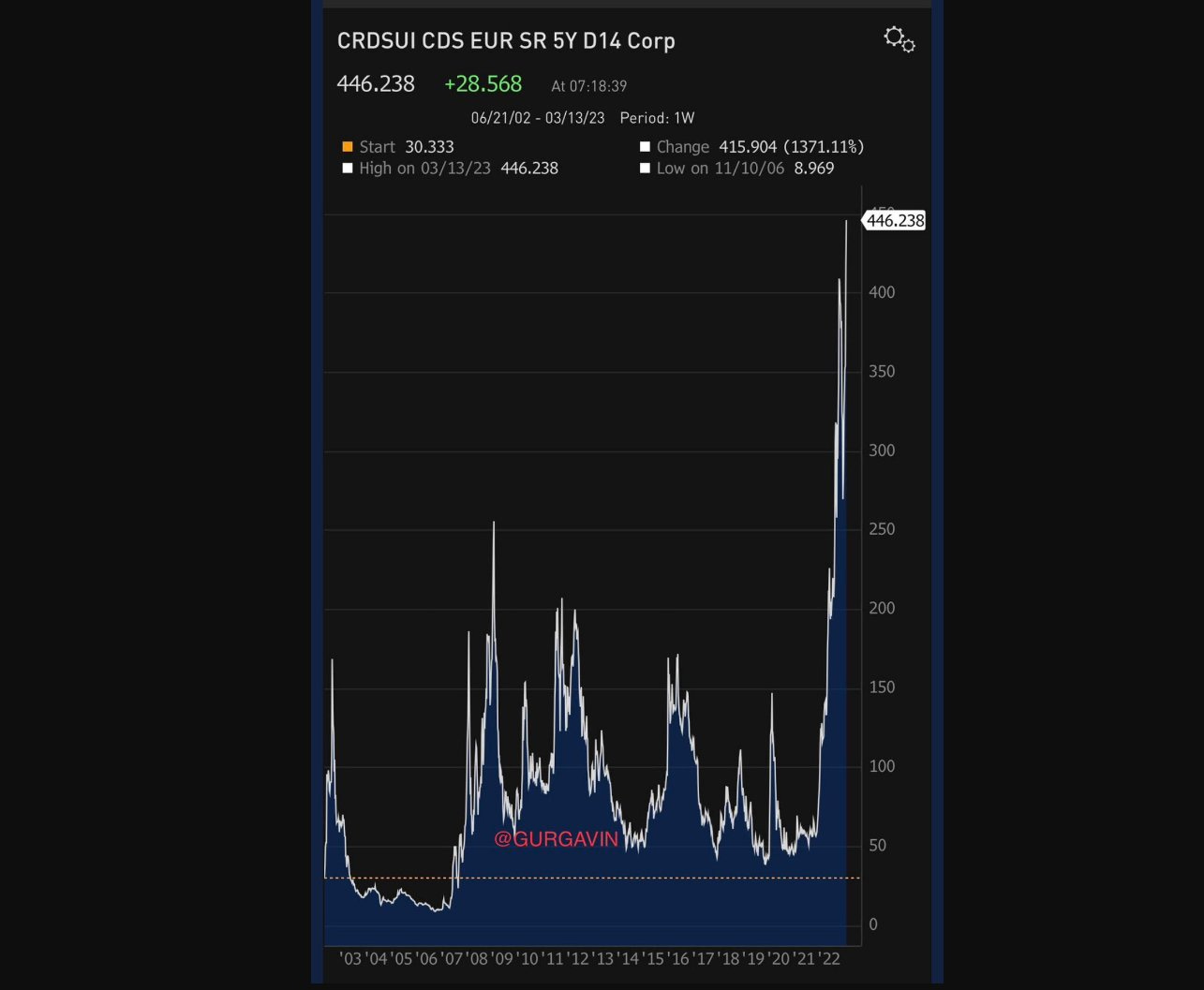

Credit Default Swaps are best understood as insurance against an institution defaulting on its obligations. They are priced in the market and the market is pricing the Credit Suisse risk at about 8 times what it was priced at last week. From just over 50 to 446. Yikes!

Where Silicon Valley Bank operated principally in California, Credit Suisse operates all over the world. A net few billion dollars will clean up SVB, what it will cost to “save” Credit Suisse is likely in the hundreds of billion dollar range. You will probably have heard of the “fear of contagion” vis a vis bank collapses, well, Credit Suisse is the Ebola of such contagions.

Gold and silver rose a bit on the SVB collapse news. But not a lot simply because the US government moved quickly to protect depositors even over the $250,000 limit. Confidence came back to the market and so the rush to “hard assets” was muted.

The spot price for gold and silver essentially reflects the “paper” market. People exchanging promises to make delivery of metal which never actually leaves the vault. It reflects an abstract financial value of gold and silver and tends to respond to financial market concerns. It is also subject to a lot of market “game playing”, if not outright manipulation.

As I pointed out on Twitter, my bullion dealer here in Victoria offers one-ounce silver Maple Leaf coins at a premium of $7.50 Canadian over Canadian spot. Before Christmas, those premiums were over $11.00. My dealer sets his premium based on the fact he needs to replace the inventory he sells. The more available physical silver is the lower he can afford to go in setting his premium.

There is a disconnect between the financial market for paper silver and the retail market for physical silver. Retail silver buyers reflect the level of anxiety of ordinary people about how serious the economic circumstances actually are. At the moment that anxiety seems to be low and the collapse of a couple of banks no one has heard of has not increased it much. Traders in financial markets are twitchier.

[Oh shit!]

All that will change if Credit Suisse goes under. The traders will go nuts because Globally Systemically Significant Financial Institutions can’t go bust without there being a severe threat to the entire financial system. Credit Suisse is the counterparty to literally millions of transactions representing billions, if not trillions, of dollars. It fails and the Institutions on the other side of those transactions could be left with nothing.

The mere hint of this could easily panic the financial markets in general. It really could be an “extinction level” event for big stocks, bonds, currencies and investors. This a fact which will become clear to the retail population and the idea of holding a bit of gold or silver may become very attractive.

Holding physical gold or silver is perhaps prudent as a hedge against “the shit hitting the fan” but it is a lousy investment. No dividends, no interest, need for secure storage and you generally get paid less than spot when you want to sell it.

Investing and speculating assume that the financial markets will be pulled back from the abyss. However, knowing that the chasm is yawing beneath big banks, insurers, governments and companies is likely to shake the markets, hard. Junior explorers are not an obvious choice if you want to keep your money safe. Quite the opposite really. But as many of them are already at all-time lows, despite making real headway and adding real value, in a market shakeout junior resource stocks may be the best place to recoup the money lost on big companies.

Gold and silver producers and explorers will take the hit along with the rest of the market; but if you are pouring Doré bars like Silver Bullet Mines (SBMI.V) or processing gold like Newlox Gold (LUX.CNX) or on track to produce 30,000 plus gold ounces in Q1 2023 like Orezone (ORE.T) the market may come knocking on your door.

Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment on my overall portfolio. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently own shares in Silver Bullet Mines, Newlox Gold and Orezone which I intend to hold but which I may sell at any time.]