Cartier Silver - More Polymetallic in Bolivia

Cartier Silver announced a 2 Million dollar private placement on January 29, 2024.

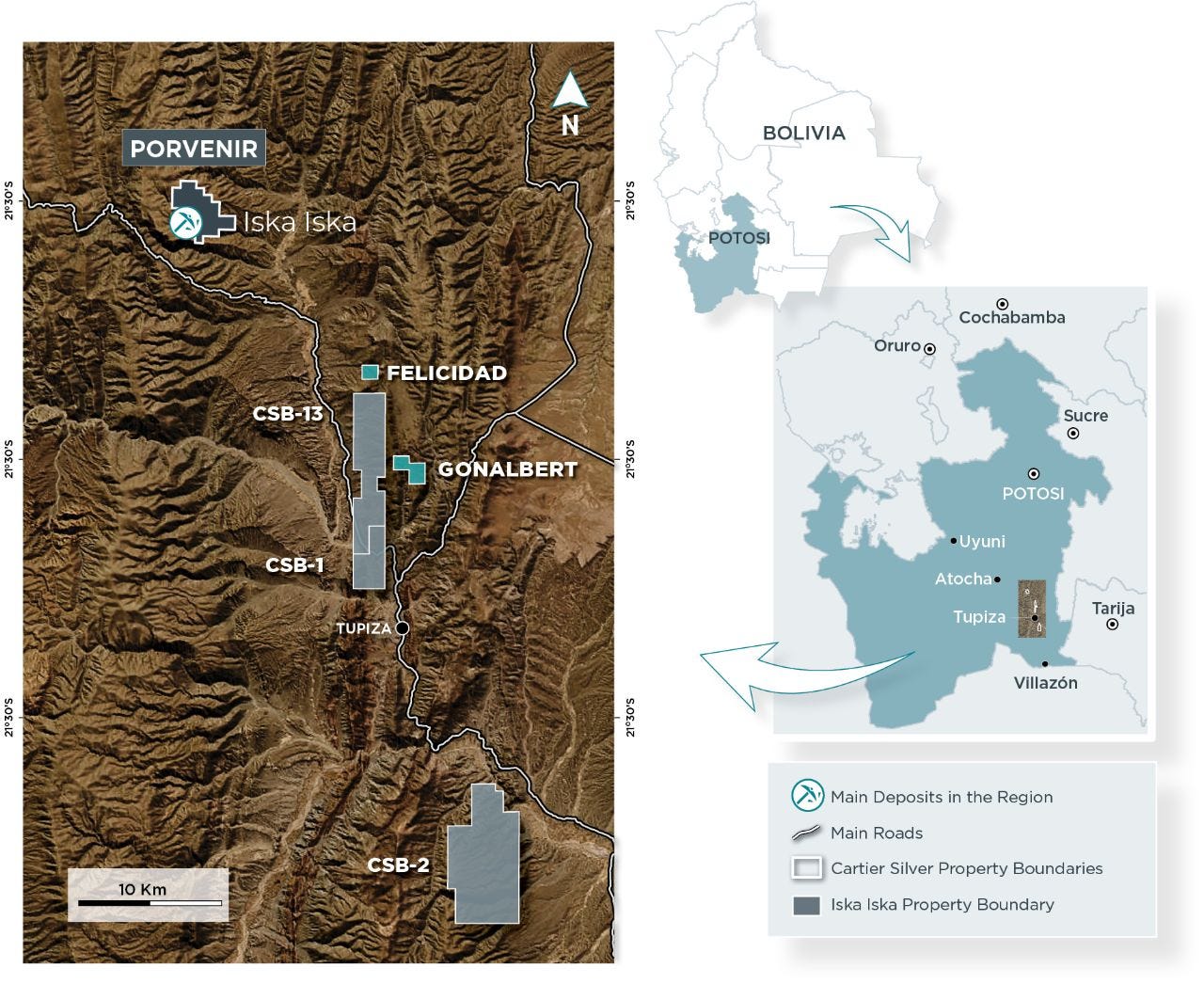

Cartier (CFE.CNX) is another Tom Larsen Bolivia polymetallic play 20 kilometers southwest of Eloro Resources’ (ELO.T) huge deposit at Iska Iska. I’ve followed ELO for years and kicked myself for not having the funds to buy it four years ago when it was trading around $0.20. (ELO is currently trading around $1.70 having hit a high of $5.30 in 2022 (want to guess where some of my position was purchased?) CFE is trading below $0.30.

The 2 million raised in the private placement, which is being offered at $0.25 with a half a $0.50 per share, two-year warrant, will mainly be used to drill test the Gonalbert property in the Chorrillos Project in the Potosi Department, Bolivia.

Where Iska Iska had a couple of very small-scale artisanal mining operations on the land, Chorrillos has a multi-level, though still artisanal, mine which produced 20 tons of 200 gram per ton silver head grade daily and delivers a lead/silver concentrate running 1300 grams Ag per ton. I wrote about the Gonalbert property Chorrillos at Motherlodetv.net back in December.

With a second payment to the landholder, the artisanal mine has been shut down to allow safe surface drilling.

Cartier has drilled three successful holes at Gonalbert and has an IP/Resistivity Study for the property. It has also conducted a systematic channel sampling programme in the underground workings of the existing mine. The further drilling, which the private placement will finance, will focus on the structures revealed by the channel sampling and will seek to confirm the IP which suggests “Chargeability becomes stronger at depths greater than 100 m, below a depleted, near-surface zone where sulphide mineralization has been extensively oxidized.”

Following the IP and the channel sampling with diamond drill holes from surface Cartier is aiming to develop a significant polymetallic deposit at Gonalbert. Strategically, however, Larsen and his team are developing Gonalbert very differently from Iska Iska.

Iska Iska is a genuinely huge deposit and, frankly, getting bigger. Gonalbert may have significant size but it also has an existing mine and what appears to be a good-sized area of mineralization which drilling will, almost certainly, confirm. In short, Cartier knows Gonalbert, has been producing and can continue to produce economic concentrate. However, Gonalbert is also a candidate for open pit-style bulk mining. It really depends on the continuity of the mineralization.

Which strongly suggests that the project is a great candidate to be “fast-tracked”. Basically, do 4000-6000 meters of infill and definition drilling, put the results into a Mineral Resource Estimate and have a significant resource ready to mine.

It should be noted that Gonalbert is just one of the properties in the Chorrillos portfolio. If you look at the map you’ll see four more, some considerably larger than Gonalbert.

From the investors’ perspective, Cartier is a potential “quick hit” instead of Eloro, which is more likely to be a long play to a world-class resource.

Far to the North, in Quebec’s Labrador Trough, there is, however, another bullish element to the Cartier Silver story. Cartier has retained a 55% interest in the Lac Penguin (Gagnon holdings) magnetite/hematite 500 million ton plus inferred iron ore deposit. A gravity survey has nearly doubled the size of the potential pit at the project.

The deposit grades 29 to 33 per cent in situ iron before beneficiation to a 64 to 65 per cent concentrate. It is a coarser grain which is less costly to process with clean, low deleterious elements and the material is suitable for greener Direct reduced iron and electric arc methodologies that use hydroelectricity in most cases. It is an iron ore product in increasing world demand.

This is, obviously, a bit of a sleeper. Very little work has been done on the property itself, however, it is in the Labrador Iron Trough, not far from rail and a deep water port. Most importantly, Lac Penguin is substantially a magnetite deposit and that rock is currently commanding a green premium. It is a solid asset to have on the books.

My investment case for Cartier rests on the promise of the Chorrillos project both for grade and scale and the potential for bulk mining. Like Eloro, Cartier is really an exploration rather than a development company. It is in the derisking business. Which means the likely endgame for Chorrillos the the sale or joint venturing of the project once the resource has been proven up.

Right now, while there are long intervals of good grade in the initial drill holes, the size of the deposit will require more drilling to determine. But it is pretty clear that it will not be small.

The happy thought is that Chorrillos’ potential will be recognized by the market and the shares will be rerated in much the same way as Eloro was. But faster.

[Disclaimer: I own shares in CFE and may buy or sell at any time. This is not investment advice.

Do your own due diligence. Call the CEO.]