Bayhorse Silver: Real Assets for tough times

I own bucket loads of Bayhorse Silver (BHS.V). It is trading at $0.015 as I write and I am a long way in the red on my investment. But I am very optimistic and I see no reason at all why my investment will not turn out to be successful. Which suggests I might be smoking the good stuff. After all, Bayhorse has almost no money in the bank, a silver mine in Oregon which is stuck in permit Hell and virtually no capacity to raise the capital it needs to continue.

Which is where my many conversations with Bayhorse CEO, Graeme O’Neill have often started. However, unlike many junior resource companies, Bayhorse has more than just a mine waiting for a permit: it has actual, paid for, assets - an ore sorter at the mine and a mill in Idaho.

Two days ago, Bayhorse announced that it had reached an agreement with Canadian Critical Minerals to rent CCMI BHS’s ore sorter to allow CCMI to process its 180,000 ton run of mine copper/gold stockpile for processing at the New Afton mill near Kamloops, BC. Using the ore sorter CCMI will reduce the amount of material to be processed to 90,000 tons saving a great deal of money on transportation and processing costs. Bayhorse has not disclosed the terms of the rental agreement but it is safe to say the revenue will cover costs associated with the ongoing permitting process in Oregon and pay for some drilling at BHS’s Brandywine Falls gold project in BC.

Frankly, the rental, in all likelihood saved the company.

With a little wind in his sails, O’Neill’s next opportunity will be to do some toll milling at Bayhorse’s Payette Idaho processing facility. A facility which is surrounded by small scale gold and silver mining operations.

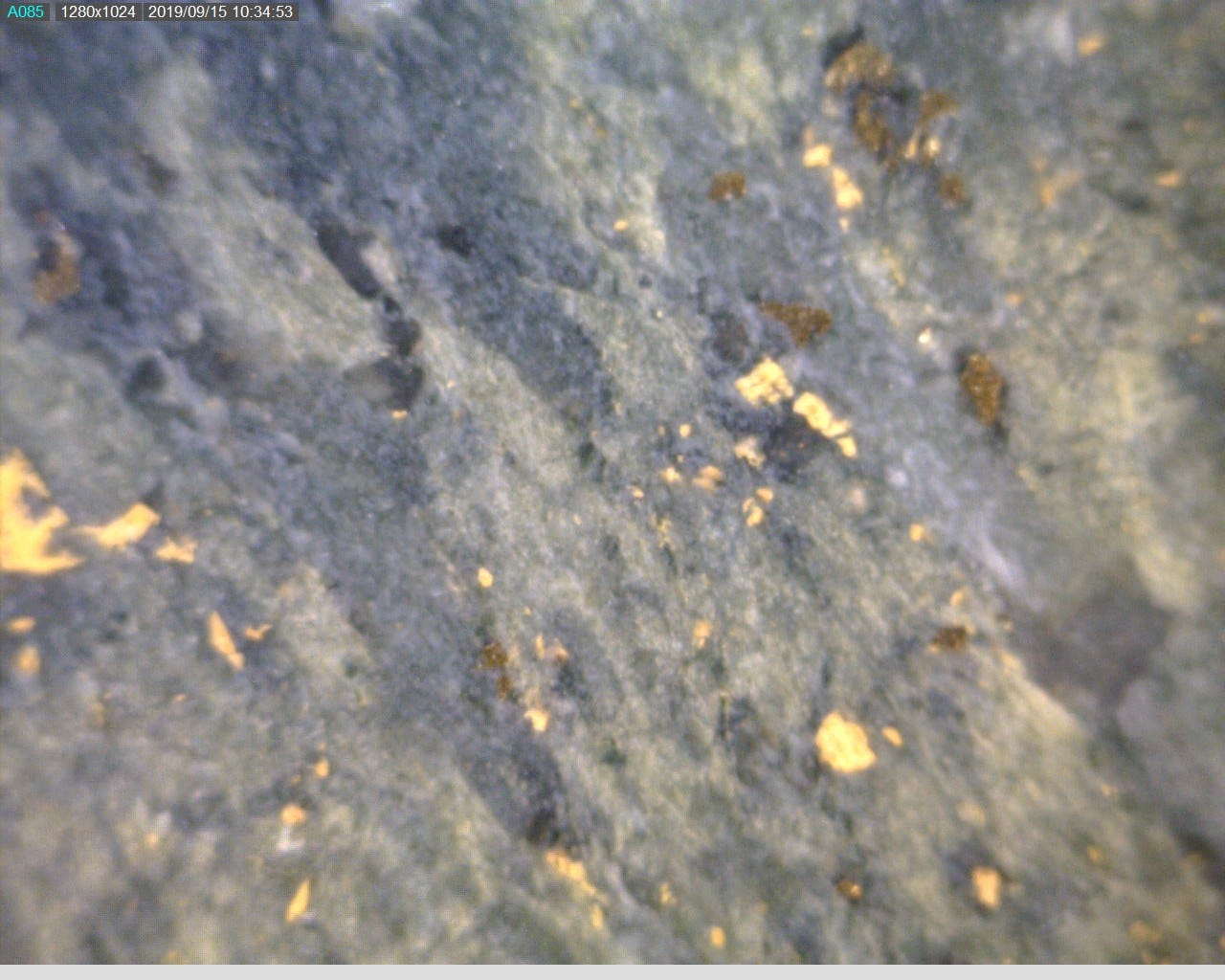

The “blue sky” in all of this is the Brandywine property. As discussed in the press release, Bayhorse has already conducted assays on existing 2010 drill cores from Brandywine which returned grades as high as 20 gpt gold over one meter and 11 gpt over 3 meters. These results are relatively close to surface, 20-35 meters down.

Drilling at Brandywine would likely be fairly short holes designed to outline a potential bulk sample. Bayhorse knows there is gold there. The question is, can it be economically recovered? It is a question that can only be answered by drilling a relatively small part of the property. A part of the property which has already had some drilling done so it is a pretty good bet that the BHS drill holes will hit reportable gold mineralization.

The lifeblood of junior resource companies is hard news. Actual drill results. Drilling costs money and, until the ore sorter rental, BHS had, practically, no money at all. Now the company has some money and that will almost certainly mean it will commence drilling at Brandywine. The Brandywine property is a little over an hour from Vancouver so the drill core can get to the lab in short order.

Obviously, there are no guarantees that the drilling will produce results which the market will respond to. However, even a steady stream of “OK” results should increase interest in Bayhorse shares. Now, were there to be a few holes with 10+ gpt intervals, interest would turn to excitement.

Gold itself is having a bit of a moment rising a bit over $60 in the last three days. In rising gold markets, cheap shares with actual gold results can swing from oversold to overbought on the strength of a couple of solid news releases.

The fact is that Bayhorse has had a near-death experience. If its only assets had been a permit pending mine, a bit of prospective land and a warehouse with 50,000 meters of drill core, I don’t think the company would have pulled through. O’Neill put BHS’s money into hard assets rather than a lot of drilling at the Bayhorse Mine. Those assets have ensured that Bayhorse survives to fight another day.

At its current beaten-down price Bayhorse offers an opportunity to trade a highly prospective gold play and invest in a permit pending silver mine for, literally, next to nothing.

[Disclosure: Graeme O’Neill is a friend. I own shares in Bayhorse Silver (BHS.V), a lot of shares, and may buy more or sell some or all at any time. This is not investment advice. Do your own due diligence. ]