Bayhorse Silver: Break out the Drills

Yesterday’s press release is a watershed moment for Bayhorse Silver (BHS.V). Rather than waiting for a partner to help finance and execute a drill program on the Pegasus project in Idaho, Bayhorse has decided to drill underground in Oregon. It’s a gutsy and, I think, correct decision.

A couple of weeks ago I wrote:

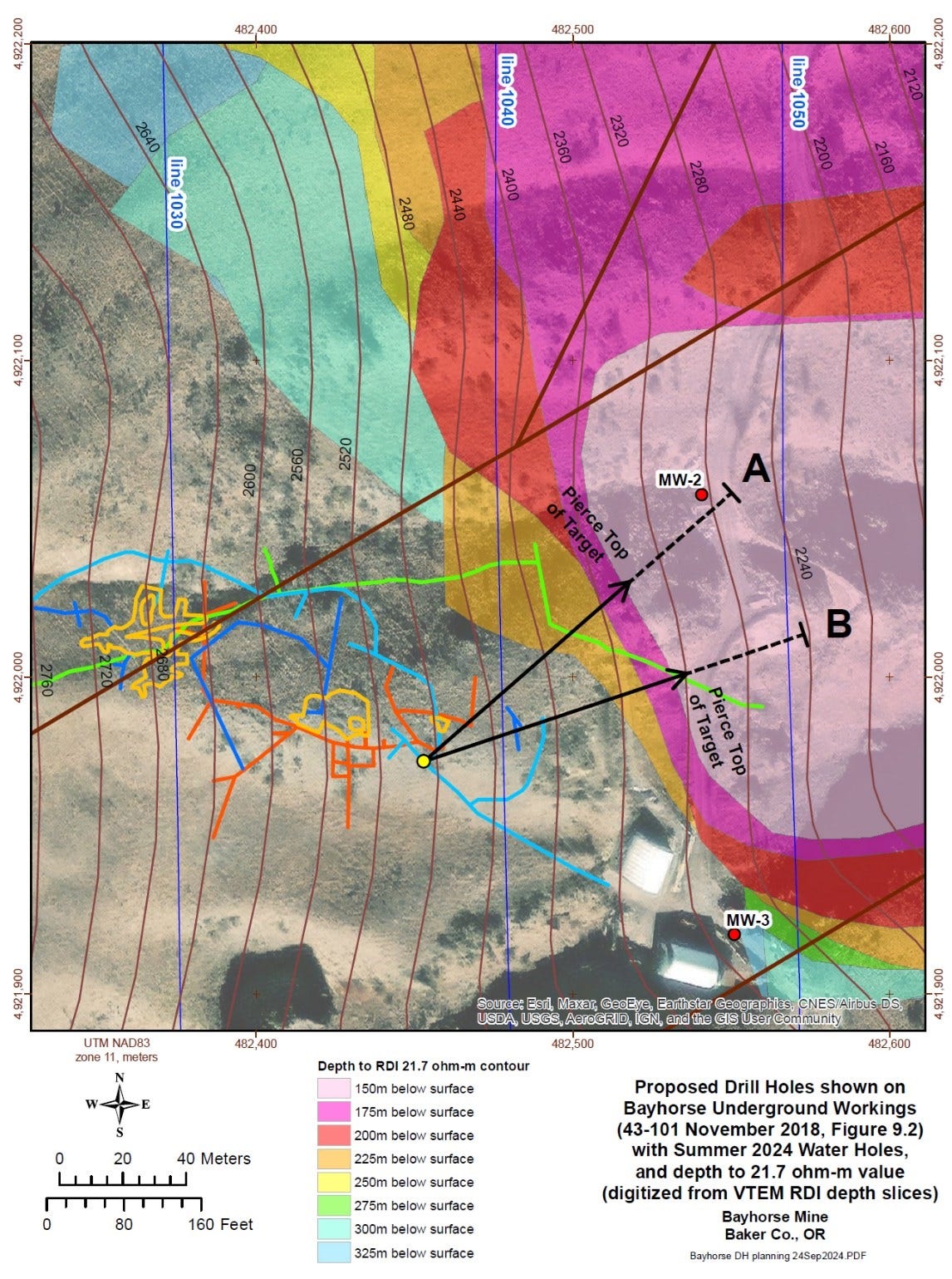

Bayhorse has always been about recommissioning the Bayhorse silver mine with little thought and less money given to the sort of exploration which the VTEM line suggests. Because it is in Oregon, getting permits for surface drilling is difficult if not impossible. But Bayhorse can drill as much as it likes from underground.

While most of the excitement is on the Idaho side, the VTEM results strongly suggest there is a significant anomaly beginning all of 200 feet down and 500 feet easterly from the Bayhorse mine workings. Given the significant copper credits in the Bayhorse mine concentrate produced so far, there is every reason to believe that this anomaly may be a copper porphyry along the lines of the Hercules Metals blind porphyry at Mt. Cuddy.

Drilling from an underground station at the Bayhorse mine is not weather dependent, needs no new permits and a preliminary campaign can be mounted for $100,000 to $120,000 per 1000 foot hole.

The program can commence as early as next week.

There is not a 100-meter, barren, basalt cap over interesting rock. The water test drilling holes (marked M2 and M3), while they cannot be assayed, give Bayhorse some idea of the nature of the rock the diamond drills will encounter.

Every foot Bayhorse drills will give O’Neill and his geo team very useful information about the geology surrounding and underlying the existing mine. To date, Bayhorse has drilled to define mineable targets. Short holes largely confirming what the company already suspected about the Bayhorse Mine workings. “Exploration”, whether VTEM or drilling, was not on the BHS agenda. There was more than enough silver/copper/gold/antimony to keep the mine operating profitably for years.

The Hercules (BIG.V) discovery at Mt. Cuddy on a terrane suture structure very similar to the rhyolite structure at the Bayhorse mine, goosed the market and allowed O’Neill to raise the money to fly a VTEM and stake the ground where significant anomalies appeared on both sides of the Snake River. While the Pegasus structures came as something of a surprise, Dr. Conway had mapped the Idaho extension of the Bayhorse rhyolite several years ago.

The VTEM results under and to the north of the Bayhorse mine were not geologically surprising either. The silver and copper had to have come from somewhere and what Dr. Conway has described as a “regional magmatic episode” suggested that there would be the possibility of porphyries at each of the suture points.

The VTEM suggested that there was a promising target at Bayhorse’s front door.

A properly mounted drilling program at Pegasus will cost 3-5 million dollars. It will involve drilling though 100 meters of barren basalt before hitting even mildly interesting rock. Plus, at best, there are about 45 days left in the drilling season before winter closes in. A lot of time and financial pressure to, perhaps, drill two of the five holes the planned program calls for. If BHS was rolling in money it might have made sense to get those holes, but BHS is not in that happy position. So Pegasus can wait until Spring. The porphyries are not going anywhere.

Drilling Pegasus entails a significant logistical operation - likely fully helicopter-supported drilling: drilling underground at the Bayhorse mine is a matter of moving a drill into the station. All that is required for a drill program, power, water, underground equipment, even a large shelter which can be used as a core cutting station and for core storage, is in place and paid for. The road up to the Bayhorse mine is easily cleared of snow in winter.

It is obviously impossible to say what the underground drills will hit. But every foot will be useful to the planning of an existing mine. But for a permit which should be granted this coming year, Bayhorse is ready to start mining. Having two or three long holes will also give BHS the capacity to do “downhole IP” which will be very useful in identifying a potential porphyry as well as areas of mineralization accessible from the current mine.

From the investor’s perspective, underground drilling will produce a steady news flow. Yes, it would be grand if the holes end up in a copper porphyry, but that’s the billion dollar prize. Along the way to that prize there is a lot of very prospective rock to drill and results to report. Plus the prospect of downhole IP across the whole BHS mining area.

Now for a little “just for paying subscribers” discussion of BHS and BIG. Just below the disclaimer.

(Disclaimer: Graeme O’Neill is a friend and I own shares in Bayhorse Silver and may purchase or sell at anytime. I also own shares in Hercules Metals. This is not investment advice. Do your own due diligence. Call the CEOs.)

Keep reading with a 7-day free trial

Subscribe to Talking My Book to keep reading this post and get 7 days of free access to the full post archives.