Bayhorse Drills Below Its Oregon Mine

(I wrote this a few days ago. As of December 10, BHS has confirmed that the underground drill is turning. We’ll see what is underneath the Bayhorse Mine over the next couple of weeks.)

My friend, Bayhorse Silver (BHS.V) CEO Graeme O’Neill (center of picture), is a happy camper. O’Neill, as he will tell you at length, is a logistics guy. Trained by the New Zealand Navy in the science and art of “preparing” so that problems which arise can be solved. Important when you are floating around in the great Southern Ocean. While he also held an Electrical Contracting ticket, taught skiing at Whistler and has run BHS for years as a CEO, what actually makes him happy is solving problems as they come up.

Drilling underground at the Bayhorse Mine in Oregon with a small crew of professionals offers just the right set of problems for a man of O’Neill’s talents. Need to make headroom for the drill? A well-placed jackhammer is a good solution. Gen- set putting out incorrect voltage? The right transformer can fix that. There are lots of these little, but potentially show-stopping, problems and O’Neill loves being on-site to solve them.

Plus take a few pictures and videos of the progress being made. Which you can see here. https://bayhorsesilver.com/bhs-ugdrillingimages/

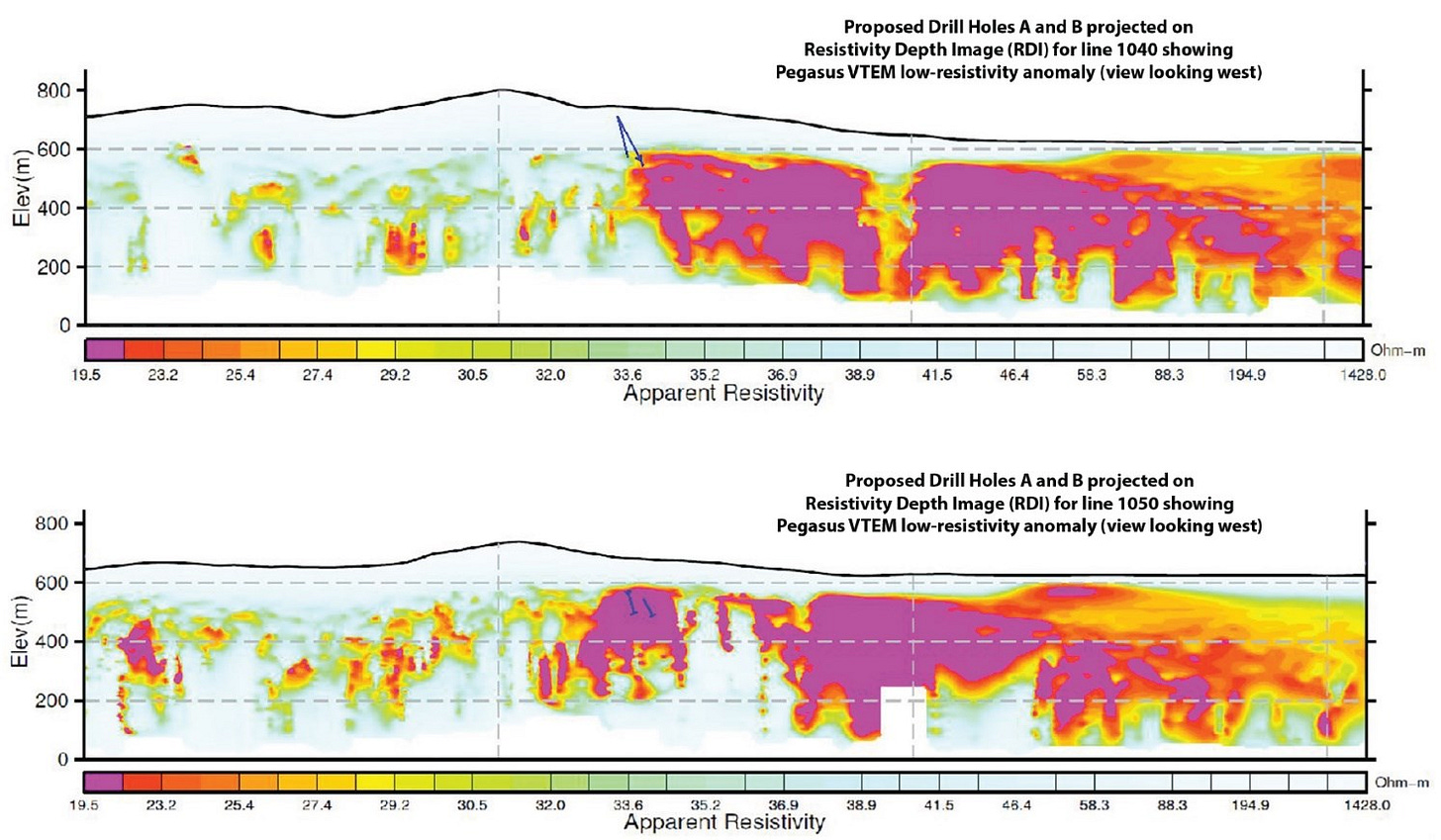

Bayhorse is drilling to pierce an anomaly identified in its VTEM survey of property it holds on both sides of the Snake River which divides Oregon and Idaho. The theory is that these anomalies will be similar to the copper porphyry drilled by Hercules Metals downriver. The geology of the sutures between the Izee and Olds Ferry terranes should be similar and, with luck, Bayhorse will drill into its own copper porphyry.

The drilling is also important because it is the first real “exploration” drilling ever done at the Bayhorse Mine site. The drilling at the site, to date, has consisted of short holes intended to guide mining operations and establish a 43-101 compliant resource estimate at the mine. The silver, gold, copper and antimony found in the Bayhorse Mine concentrate has to have come from somewhere. The planned underground holes, long before they reach the anomaly, will provide important geological information about the Bayhorse deposit.

While the deployment of the drill is a disclosed material fact, things get a bit more interesting when the drill starts turning and bringing core to the surface. All of a sudden the disclosure, and non-disclosure, rules kick in. What O’Neill can and cannot say becomes very important. A driller, on video, saying “Now that’s ore.” is an absolute no-no. “Ore” is a defined term meaning economically viable material. The driller might be looking at a foot of solid silver but “ore” involves a lot more than just mineralized rock no matter how high grade.

National Instrument 43-101 governs what junior resource companies must say, may say and may not say. A company must disclose material facts in a timely manner. A company, with proper disclaimers, may make limited “forward looking” statements. A company, prior to completing certain 43-101 compliant procedures, is very limited in what it can say as to the economic viability of a deposit.

The 43-101 regime was created in the wake of the Bre-X fraud back in 1997. Its essential purpose is to protect the investing public by ensuring that misleading, erroneous or fraudulent information relating to mineral properties is not published and promoted to investors.

At the heart of the 43-101 process is the attribution of information contained in press releases, technical reports and related documents to a “qualified person”, most often a professional geologist or engineer. At a minimum, the QP has to affirm that he or she has either prepared, supervised or approved of the technical content of the report.

Here’s where it gets tricky. NI 43-101 is largely designed to deal with written reports such as Technical Reports, Mineral Resource Estimates, Reports of Drilling results (press releases) and Reports like Preliminary Economic Assessments (PEAs), Pre-Feasibility Studies and Feasibility Studies. Situations in which there are results assayed by an independent lab or economic analysis performed by an independent third party. Though a QP may also sign off on things like a report of a VTEM survey or soil sampling program.

There is an obvious tension between the promotional inclinations of most CEOs and the reporting and QP requirements of NI 43-101.

Resolving that tension is not at all easy. There is much chat about CEOs “dropping bread crumbs” but, frankly, that is a high-risk, low-reward activity. Partial disclosure may be more misleading than no dislosure at all. Just talking about “the good bits” is exactly what 43-101 wants to avoid.

Another tactic is publishing core photos without commentary. While widely accepted, this too can be misleading: 10 feet of an 800 foot hole is a long way from the whole story.

A potential solution to the core photo dilemma is to actually provide commentary along with the photos but confine it to the geology the core photos illustrate. In the case of the underground drilling at the Bayhorse Mine there is a very good chance that the core will change as the drill bites into the anomaly. In the promoter’s perfect world, that change would be very obvious indeed. In the real world, a trained geologist would be able to explain the geological alteration, if any.

Some guidance may be provided by using an XRF machine to scan the core. X-ray fluorescence is not a substitute for core assays but it can certainly indicate if core is mineralized or not and what elements are present.

O’Neill is going to be very happy when all of the vexing problems he is helping to solve are nailed and the drill is turning. But that is just the very beginning of the “process”. A process which raises a different sort of problem altogether.

The next few weeks are going to be very, very interesting for BHS shareholders as O’Neill walks the disclosure tight rope.

(Disclaimer: Greame O’Neill, Bayhorse CEO is a friend. I own shares in Bayhorse Silver and may purchase or sell at any time. This is not investment advice. Do your own due diligence. Call the CEO.)