Banyan Gold: Building reserves in Yukon

One of the people I am really looking forward to seeing at VIRC is Tara Christie, CEO of Banyan Gold. I first met Tara unloading plywood from a float plane in the pouring rain. I was on the Yukon Mining Tour and had not a clue who she was. We all got out of the rain and into the cook shack and as we were drying off, the woman who had been unloading the wood walked to the front of the room and began to present Banyan Gold (BYN.V).

A couple of years later I finally bought shares in the company, not as many as I wish I had, but enough to be interesting. BYN is one of the few juniors I hold which has been “green” since I bought it.

Frankly, BYN is pretty much the model for a junior exploration company. It has a very prospective property just down the road from John McConnell’s Victoria Gold’s (VGCX.T) Eagle Gold Mine. It is cashed up with Christie reporting in her Letter to Shareholders a treasury of 19 million dollars coming into 2023. BYN has a 4 M oz inferred Mineral Resource Estimate and has a track record of adding ounces for $5/oz.

Along with Christie’s leadership and deep understanding of the geology of the Yukon (she was driving a bulldozer at 9 at her father’s placer workings and went on to B.Sc. and M.Sc. degrees from the University of British Columbia and registration as a professional engineer in British Columbia and Yukon) Banyan also has Paul Gray as its VP Exploration. Paul has been trenching and drilling at Victoria Gold’s Dublin Gulch Project for a decade and knows the geology of the area intimately. Paul is another pal I hope to see at VIRC.

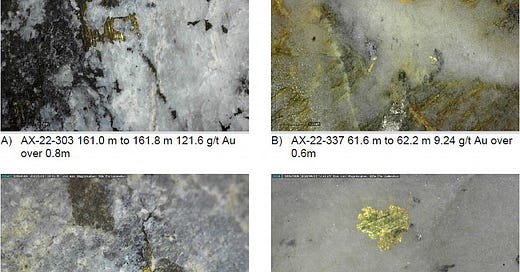

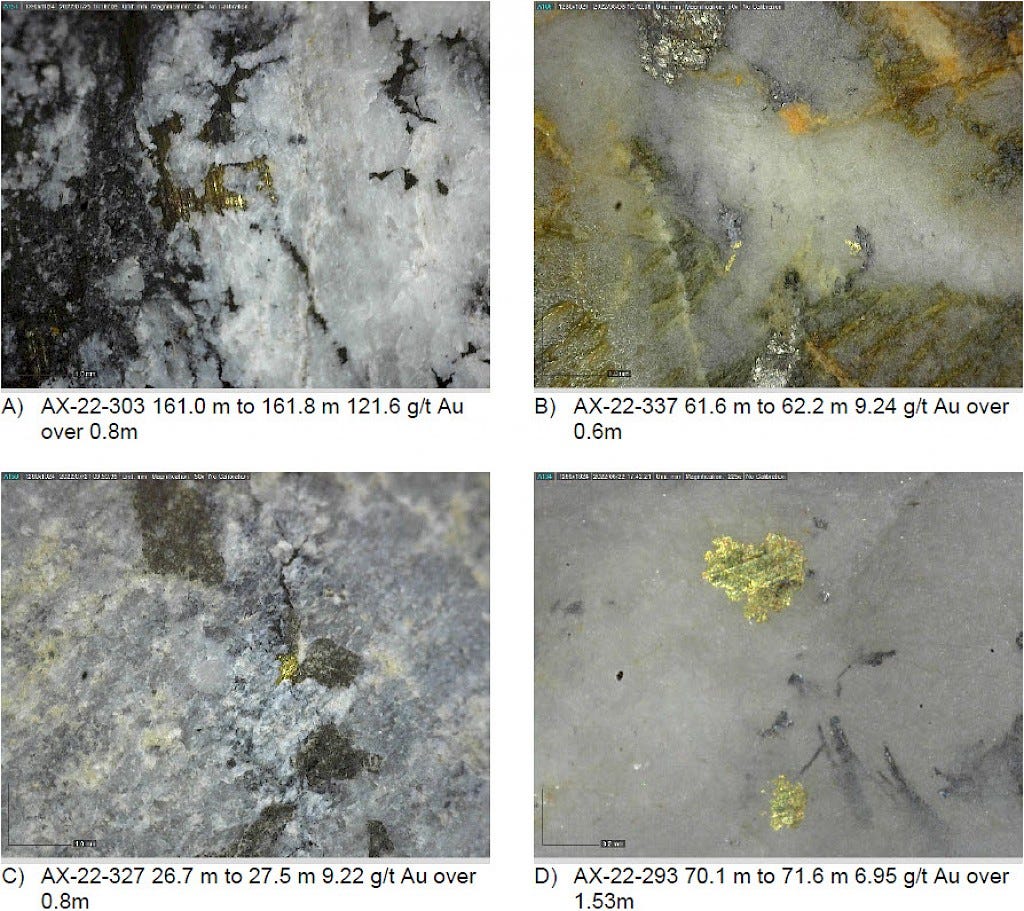

You can look at the headlines of BYN’s 2022 Press Releases to get a sense of the work undertaken and the results achieved at the Aurmac property. The grades are not “flashy”, rather they are consistently good (and sometimes, very good). They are also over significant intervals: 20 meters is good, 84 meters is outstanding.

Critically, the Aurmac property is road accessible and power is up the road at the Eagle Mine. Christie is on track to proving up a Tier One project.

My readers know that I typically sell part of my position when there has been a substantial rise in the price of my shares. And I might well sell a few BYN shares when it breaks $1.00. Note, I said “when”, not “if”. Banyan is actually just rolling onto the value launch pad. At the moment BYN has a market cap of 140 million dollars. It has 100 drilled holes awaiting assay. So news will flow even as this drilling season gets underway.

Holding Banyan for a few years would be smart if the gold price stays where it is, but it will be brilliant if gold breaks out as many people think it will.

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in BYN.V and while I have no plans to sell anytime soon I reserve the right to take profits as they arise.]