91 grams per ton Silver at Eloro's Iska Iska project

I am waiting to chat with Eloro (ELO.T) CEO Tom Larsen for Motherlodetv.net. ELO put out a release with its metallurgical hole drilling results plus a lot of very important, if technical, results from testing the bulk samples recovered.

The headline number, 91 gpt silver perked the market up. Earlier drill holes had come in at 31 grams per ton which was good, but not great, for a silver deposit. It also appears to have been an artifact of the narrow holes drilled for exploration purposes. Metallurgical holes are wider and tend to be more representative of the actual mineralization encountered. (They are also slower and more expensive to drill.) The broader cross section means that a metallurgical hole is more representative of the actual material encountered in a deposit.

The key thing to note about the “bulk sample” is that the starter pit at Iska Iska will be a bulk mine. So the bulk sample is far more representative of the expected mining experience than core from exploration drill holes can be.

I’ll be asking Tom whether the met holes will be integrated into a revised Mineral Resource Estimate and what the expected effect will be. Modelling a deposit is a bit of a dark art but, in general terms, the higher grades from the met holes should boost the overall reported grades in the revised MRE. And it could move a lot of tonnage from the inferred category to indicated. And, by a lot, we may be talking about 100’s of millions of tons of economic rock.

While the headline was the head grade tripling, there is a lot more to the release. The material from the metallurgical drilling, 7.9 tons of it, was shipped to Wales (with some going to Germany) for metallurgical analysis and testing for ore sorting. This is really Preliminary Economic Analysis level work but work which needed to be done in any event.

The results are reported in the news release and they are, frankly, far too technical for me to express any opinion on. I’ll leave it to a quote from

Mike Hallewell, newly appointed as Eloro’s Senior VP Engineering Projects/Metallurgy said: “The results indicate that 91.9% of the Silver and Lead, and 76.0% of the zinc can be pre-concentrated into a relatively high-grade mill feed product constituting only 46.6% of the original tonnage.”

From a mining perspective, the less material you have to move the better. Using ore sorting to separate out the higher grade rock before processing and Dense Media Separation on the “fines” will improve the profitability of mining at Iska Iska and probably reduce overall CAPEX. By how much will be part of the PEA.

For once the market actually rose on what is very clearly good news. The market rose about $0.25 on the day of the release and is up a few cents more as I write.

Bob Moriarty weighed in at Streetwise Reports saying,

Moriarty believes that the company's drill results, which saw 140 grams per tonne of silver equivalent over 136m, will drive the value of shares back up, making this a prime opportunity for investors to get in now. Moriarty stated, "It's going to be one of the top performers over the next year or two because people don't get it."

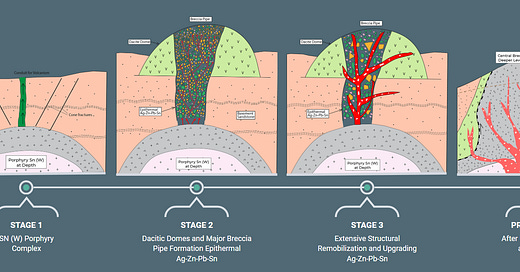

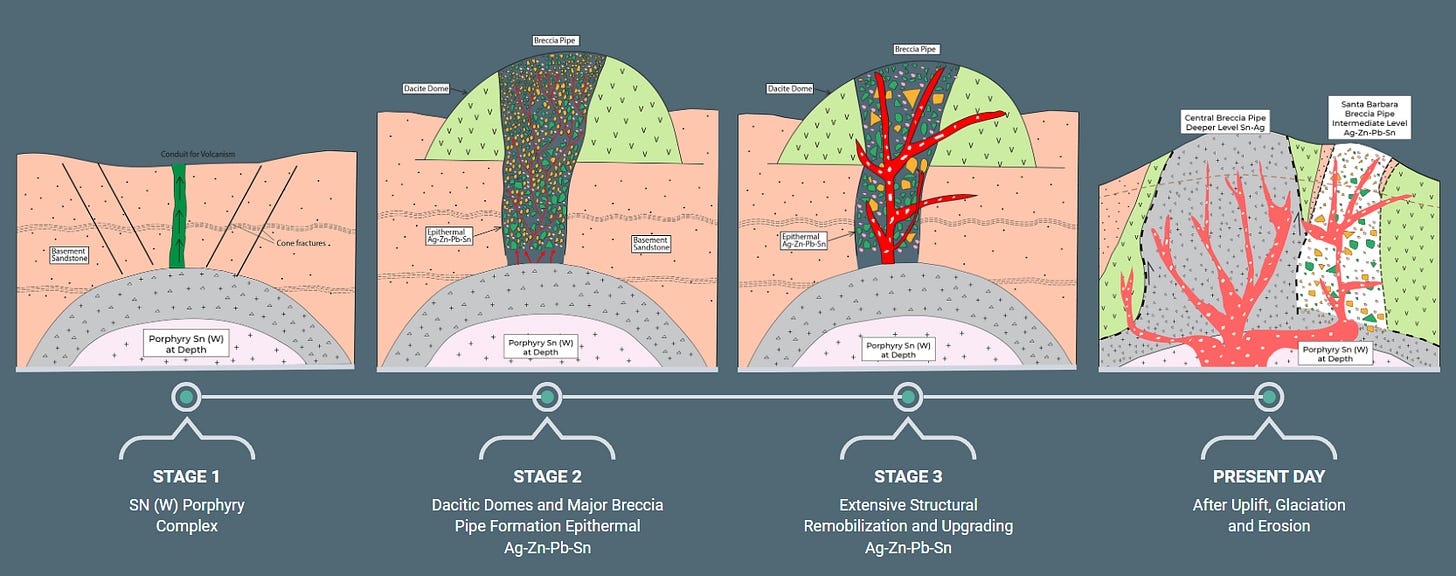

“People don’t get it” is the biggest challenge facing Tom Larsen. As I have written over at Motherlodetv.net, Eloro is too big to understand. The thing is that billion ton polymetallic deposits are outside most investors’ experience. They are complicated. They are particularly complicated because, until the Preliminary Economic Assessment has been completed and filed, Larsen and his team cannot attach dollar values to the discoveries at Iska Iska. The joy of National Instrument 43-101’s rules on proper disclosure.

Which does not mean that Eloro, and a number of large companies looking at Eloro, have not done those calculations based on the current Mineral Resource Estimate and including the recent infill and metallurgical drilling results. But until the PEA is released, ELO is unable to share even those preliminary calculations.

Telling the Iska Iska story will be a lot easier when the PEA is filed. Because then dollar values will be assigned to the disclosed resource. A “starter pit” with 150 to 200 million tons of 91 gpt silver rock is worth more than the current 150 million dollar market cap.

The current price per gram of silver in USD is $0.73, call it $1.00 Canadian. So, just on silver, a ton of Iska Iska starter pit rock would contain silver worth $91.00. The current estimated operating costs at Iska Iska are $9.40 a ton (Canadian I think but am not sure.) That is a story which the market will be able to understand.

And then, well, there is the tin…

(Update: Spoke to Tom and will be writing up our conversation in the next few days.)

[Disclaimer: This is not investment advice. I am not an investment professional. I am down about 30% at the moment. I will write about companies that I hold. I will disclose any holdings. Do your own due diligence. Do it hard. Call the CEO.

I currently hold shares in ELO.T and while I have no plans to sell anytime soon, I reserve the right to take profits as they arise.]